July 2019 had 6,955,613 units in the top 300 comics list, an increase of 684,078 units from last month. This is the highest unit total for the top 300 comics since October 2018. The dual launches of House of X and Powers of X and the final issue of Walking Dead boosted sales for the month.

Marvel Comics placed 3,486,656 units in the top 300 comics, an increase of 235,538 units and accounted for 50.13% of the total units. This increase is 117,932 less than the total sales of House of X #1 and Powers of X #1. Marvel should have a good month when the first issues of the next wave of X-Men titles are launch after these two miniseries conclude.

DC Comics placed 2,115,292 units in the top 300 comics, an increase of 318,551 units and accounted for 30.41% of the total units.

Image Comics placed 538,854 units in the top 300 comics, an increase of 55,360 units and accounted for 7.75% of the total units. The final issue of Walking Dead was up 25,431 units and a special edition of Walking Dead #192 sold 38,713 units which more than accounts for the bump in Image sales this month.

The premiere publishers accounted for 97.07% of the total units for the top 300 comics this month while all of the other publishers with items in the top 300 accounted for 2.93% of the total units for the top 300 comics. Ranks 301 to 500 sold a total of 516,556 units which is the equivalent to around 7.43% of the sales pf the top 300 comics.

The non-premiere publishers account for 5.6% of the total sales of the top 500 comics. Comics from these publishers don't sell into stores. As a result, they are less profitable for the stores since even a single unsold copy can seriously reduce or even eliminate the profit for the store on the issue. But without copies on the rack for potential customers to see, they might not know about the series. Even if they do, they aren't able to buy something which isn't available to them. This puts these smaller publishers into the challenging position of trying to increase sales while not being on the rack in front of a large portion of the of potential audience. Lower selling titles from the premiere publishers can also find themselves in this situation. While it is far from ideal, the preorder nature of comics and the Previews catalog itself does help level the playing field a little for these smaller publishers and lower selling titles.

The up-swing of 2,620,023 units from new and increased sales was enough to compensate for the down-swing of 1,935,945 units from lost sales for the net increase of 684,078 units.

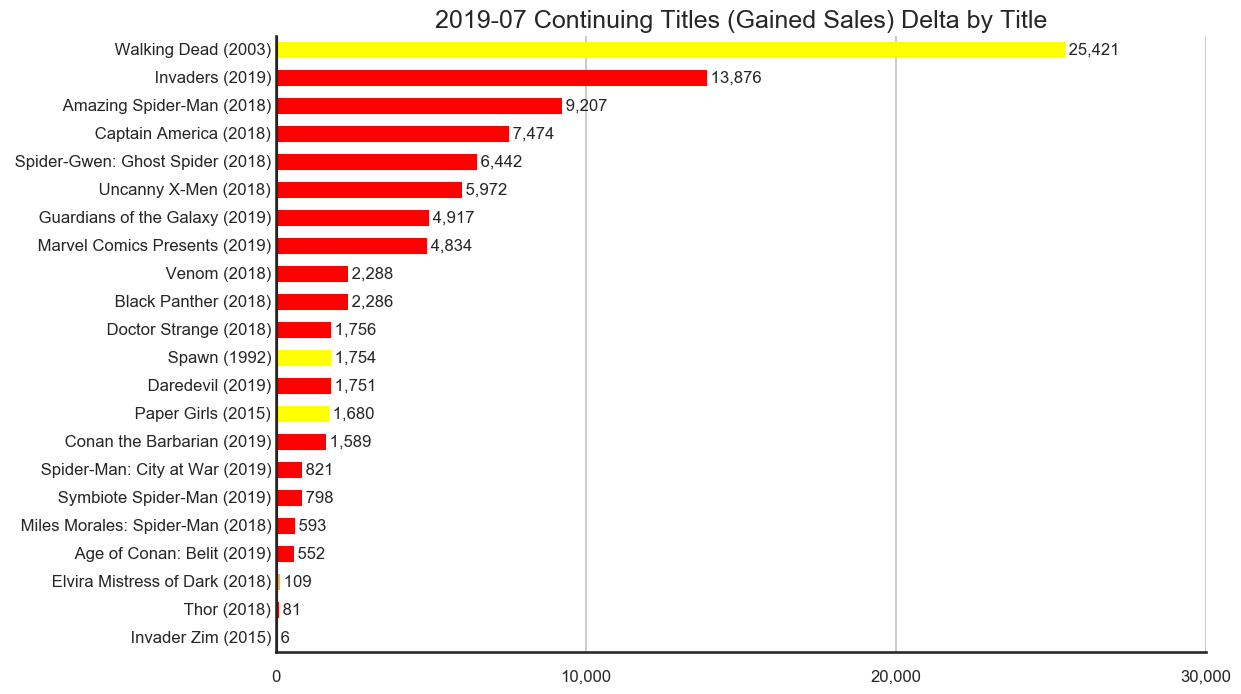

The 22 titles across the 4 publishers in the continuing titles which gained sales category accounted for 968,618 units in the top 300 comics with an upswing of 94,207 units.

The title with the biggest impact on the category was Walking Dead which accounted for 26.98% of the change in this category. Of course the irony is Walking Dead will move to the defunct title category next month since the series ended in July.

Marvel Comics accounted for 69.25% of the change in this category with notable increases on Invaders, Amazing Spider-Man and Captain America among other titles. Invaders #7 had no incentive covers and while it was the start of a new story arc that doesn't explain the increase in sales of 93.81% over the previous issue.

Amazing Spider-Man #25, on the other hand, had a regular cover, four open-to-order variants, a 1-in-10 cover, a 1-in-25 cover, a 1-in-50 cover, a 1-in-100 cover and a 1-in-200 cover. The following issue only has a regular cover and a 1-in-25 cover so sales should drop significantly on that issue. The next three issues have regular covers and a single open-to-order cover each so that change in sales on those issues will probably depend on the relatively popularity of the cover artists on those issues. Marvel is still using incentive and alternate covers to promote sales of issues but has seemed to reduce the number of meet-or-exceed covers.

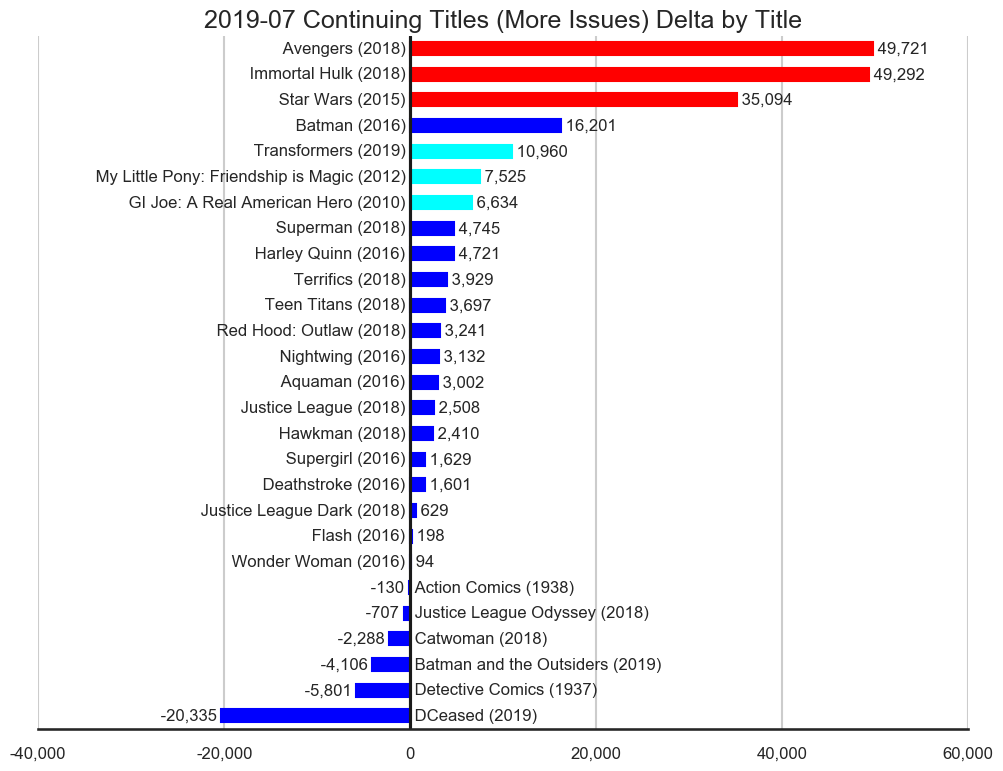

The 27 titles across the 3 publishers in the continuing titles which shipped more issues category accounted for 1,481,366 units in the top 300 comics with an upswing of 210,963 units, a downswing of 33,367 units for a net an increase of 177,596 units. There were four shipping weeks in June and five in July. Marvel Comics accounted for 75.51% of the change in this category.

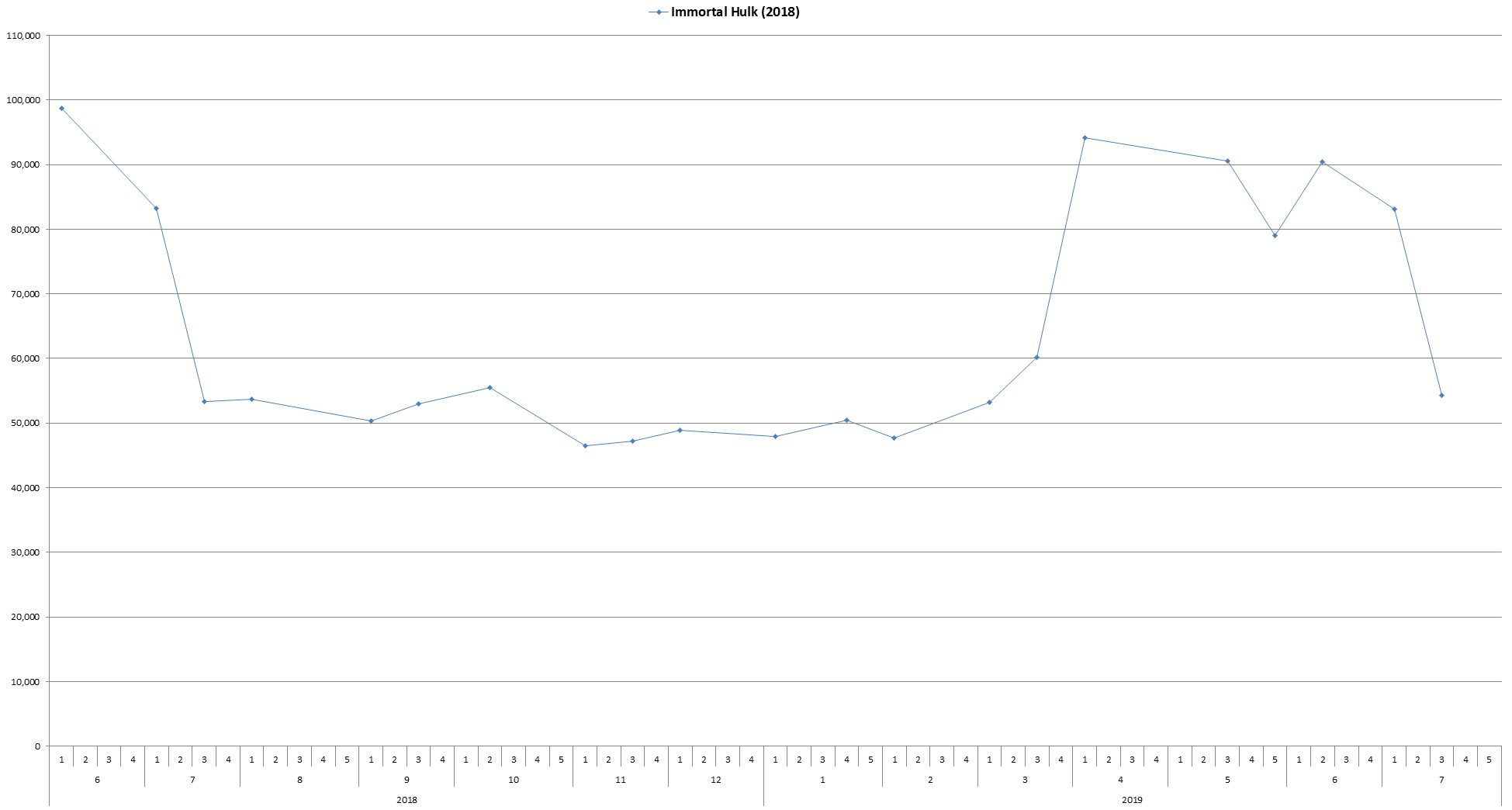

Immortal Hulk has been outselling Batman since April but Immortal Hulk #21 dropped 34.59% from the previous issue putting the title well under the sales of Batman. While the Immortal Hulk title sold more units this month by releasing more issues, the sales of the second of those two issues released in July were down significantly. Immortal Hulk #20 had a regular issue and an open-to-order Carnage-ized cover while Immortal Hulk #21 only had a regular issue. Usually an open-to-open cover doesn't had that kind of impact on sales. A closer look at the sales story of the title shows an increase in sales in March and then again in April. Reader reactions seem very positive on the title, so there is grounds to think the story content is driving sales. But the increase from around 60,000 to over 90,000 in April and the drop on Immortal Hulk #21 this month puts that into question.

The 15 titles across the 5 publishers in the continuing titles with reasonably stable sales category accounted for 169,907 units in the top 300 comics with a downswing of 2,152 units.

The 5 titles across the 1 publishers in the continuing titles which shipped fewer issues category accounted for 150,853 units in the top 300 comics with a downswing of 152,977 units. There were four shipping weeks in June and five in July. Marvel accounted for all of the activity in this category.

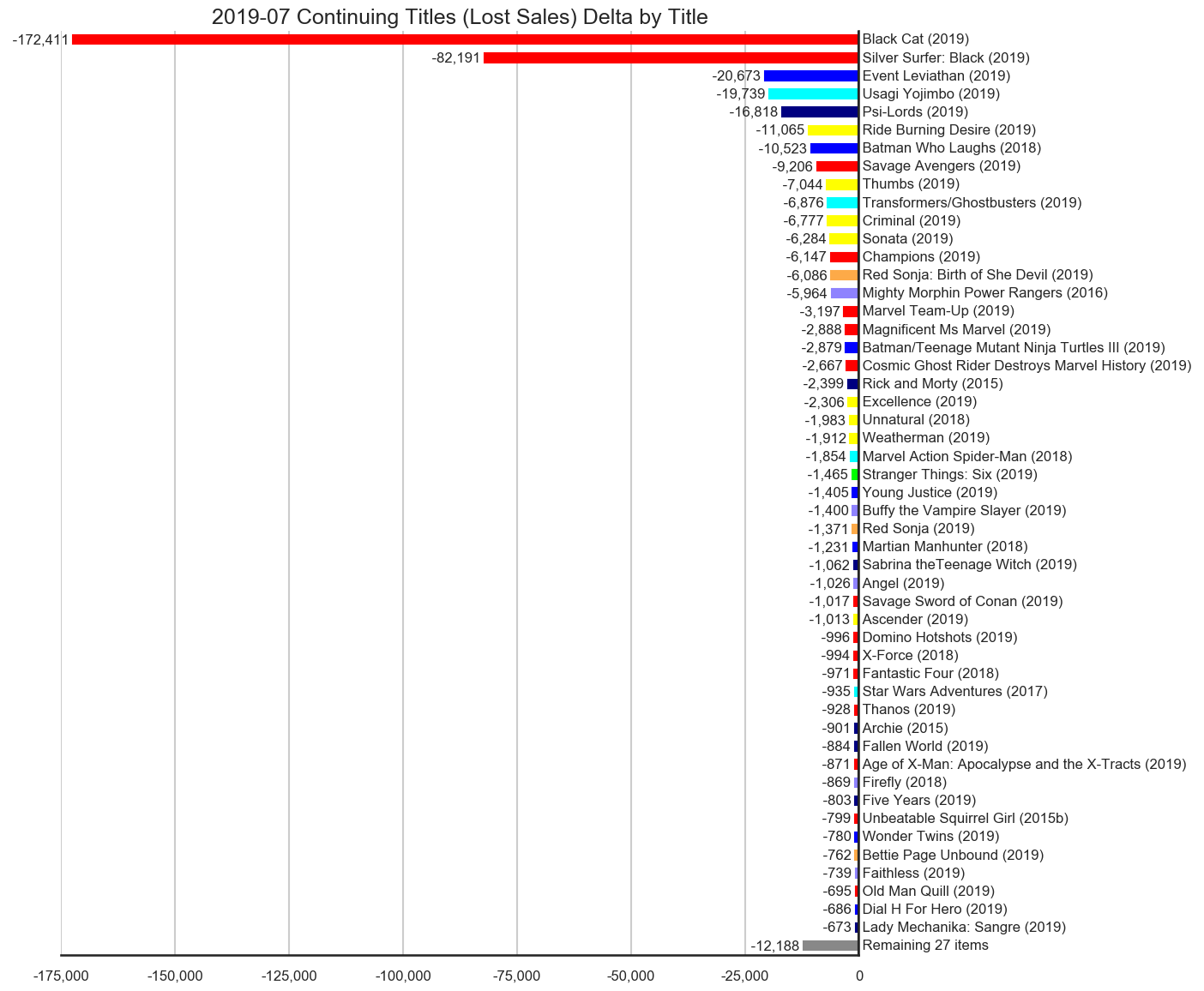

The 77 titles across the 13 publishers in the continuing titles which lost sales category accounted for 1,301,313 units in the top 300 comics with a downswing of 447,353 units.

Marvel Comics accounted for 64.66% of the change in this category. Black Cat (2019) accounted for 38.54% of the overall change in this category and Silver Surfer: Black (2019) accounted for another 18.37%. Both titles launched strong last month and had massive second issue drops this month.

Black Cat #2 dropped 67.99% from the first issue sales down to 83,298 units, which is still very strong sales. I mentioned last month Black Cat #2 had half the number of variant covers as the first issues and we should expected sales to drop but not plummet. It seems far to classify a drop of 176,892 units and 67.99% as dropping, and even as plummeting. The title will continue to have sales influenced by incentive covers, since Black Cat #3 has a regular cover, a single open-to-order cover, a 1-in-25 cover, a 1-in-50 cover and a 1-in-100 cover. Black Cat #4 only has a regular cover and Black Cat #5 has a regular cover and an open-to-order cover.

Silver Surfer: Black dropped 65.52% from the first issues sales of that title down to 47,299 units. Silver Surfer: Black #1 has a regular cover, an open-to-order cover, a 1-in-50 cover and a 1-in-100 cover while the second, third and fourth issues each have a regular cover, an open-to-order cover and a 1-in-25 cover. These sorts of massive second issue drops are commonplace for Marvel titles.

The 47 titles across the 14 publishers in the new titles category accounted for 1,597,919 units in the top 300 comics with an upswing of 1,597,919 units.

Marvel Comics accounted for 54.79% of the change in this category. House of X and Powers of X topped the sales chart in July. As should be expected, Marvel is using incentive covers to promote these titles. The first issues of each series have a regular cover, six open-to-order covers, a 1-in-10 cover, a 1-in-25 cover, a 1-in-50 cover and 1-in-100 cover. The second and third issues of each title have a regular cover, five open-to-order covers and a 1-in-100 cover. The fourth through sixth issues of each title have a regular cover, six open-to-order covers, a 1-in-10 cover and a 1-in-100 cover. That is a total of 100 covers across the dozen issues not counting the the open-to-order cover and the limit two copies cover of House of X #1 which require the opt-in to the launch party. That works out to an average of 8.3 covers per issue. The bottom line is, variant covers work for Marvel, so they will continue to use them until they are no longer profitable.

Vampirella #1 launched with 84,170 units. Retailers ordering 20 or more copies across the five alternate covers qualified to make there orders fully returnable. In addition, based on the orders of those five alternate covers, there was a1-in-10 cover, a 1-in-20 cover, a 1-in-30 cover, a 1-in-40 cover, a 1-in-50 cover, a 1-in-75 cover and a 1-in-100 cover. The second and third issue has similar cover gimmicks but without the 1-in-75 and 1-in-100 covers.

The 23 titles across the 8 publishers in the returning titles category accounted for 391,351 units in the top 300 comics with an upswing of 391,351 units.

DC Comics accounted for 56.85% of the change in this category with Batman: Last Knight on Earth (2019) accounted for 26.83% of the change in this category.

Note the lack of any Marvel title in this category. Marvel tended to get titles out every month and often multiple times a month. One way to sell more comics is to produce more comics.

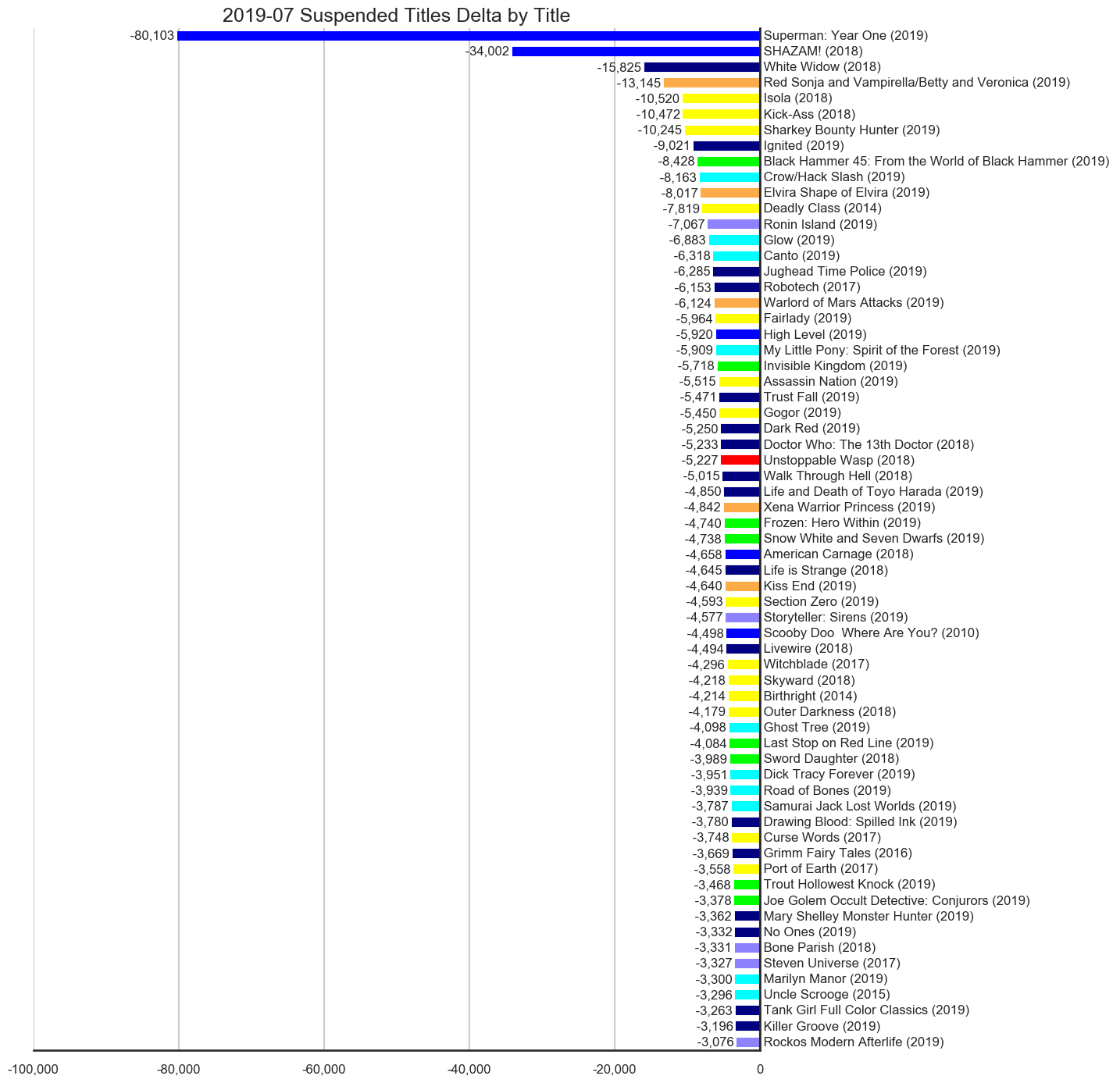

The 65 titles across the 16 publishers in the suspended titles category accounted for a downswing of 458,376 units.

Superman: Year One didn't ship in July, giving DC a deficit of 80,103 units. SHAZAM! also didn't ship this month. The opening storyline seems to be a dozen issues long, and the delays aren't likely to help the story momentum.

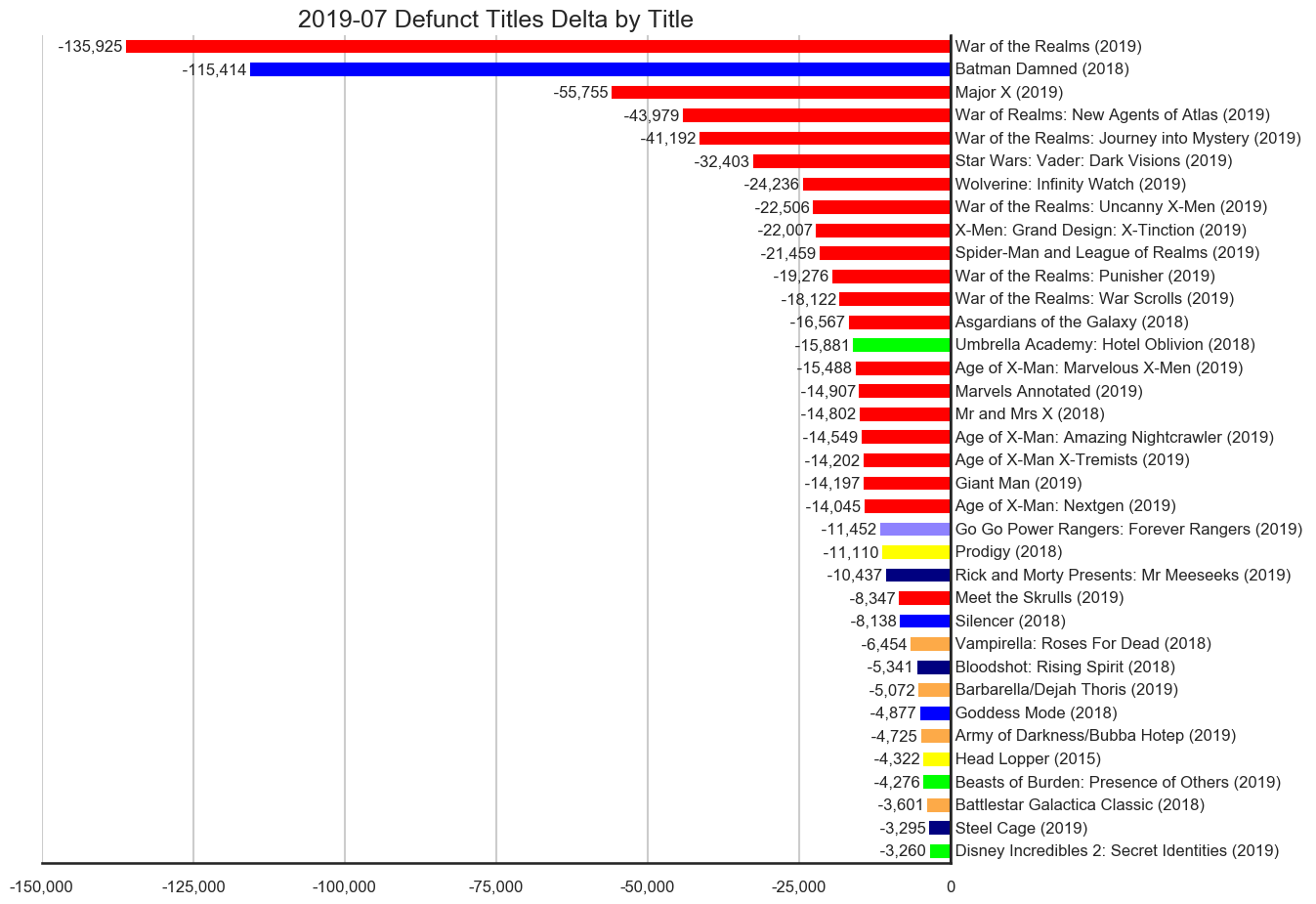

The 36 titles across the 9 publishers in the defunct titles category accounted for a downswing of 781,619 units.

Marvel Comics accounted for 72.15% of the change in this category. War of the Realms ended last month and removed 308,951 units of sales from the month-to-month total for Marvel. Age of X-Man also ended, but only removed 59,746 units. That is the difference between an event like War of the Realms which impacts the entire narrative universe, and a storyline like Age of X-Man which only impacts a family of titles. Both had an Omega issue one-shot released in July which served to close off the storylines.

Batman Damned ended last month and removed 115,414 units from DC month-to-month total.

The 4 titles across the 2 publishers in the annuals/specials category accounted for 110,538 units in the top 300 comics. DC Comics accounted for 64.98% of the change in this category with the release of three annuals in July. Image released a commemorative edition of Walking Dead #192 which accounted for the other 35.02% of the change in this category.

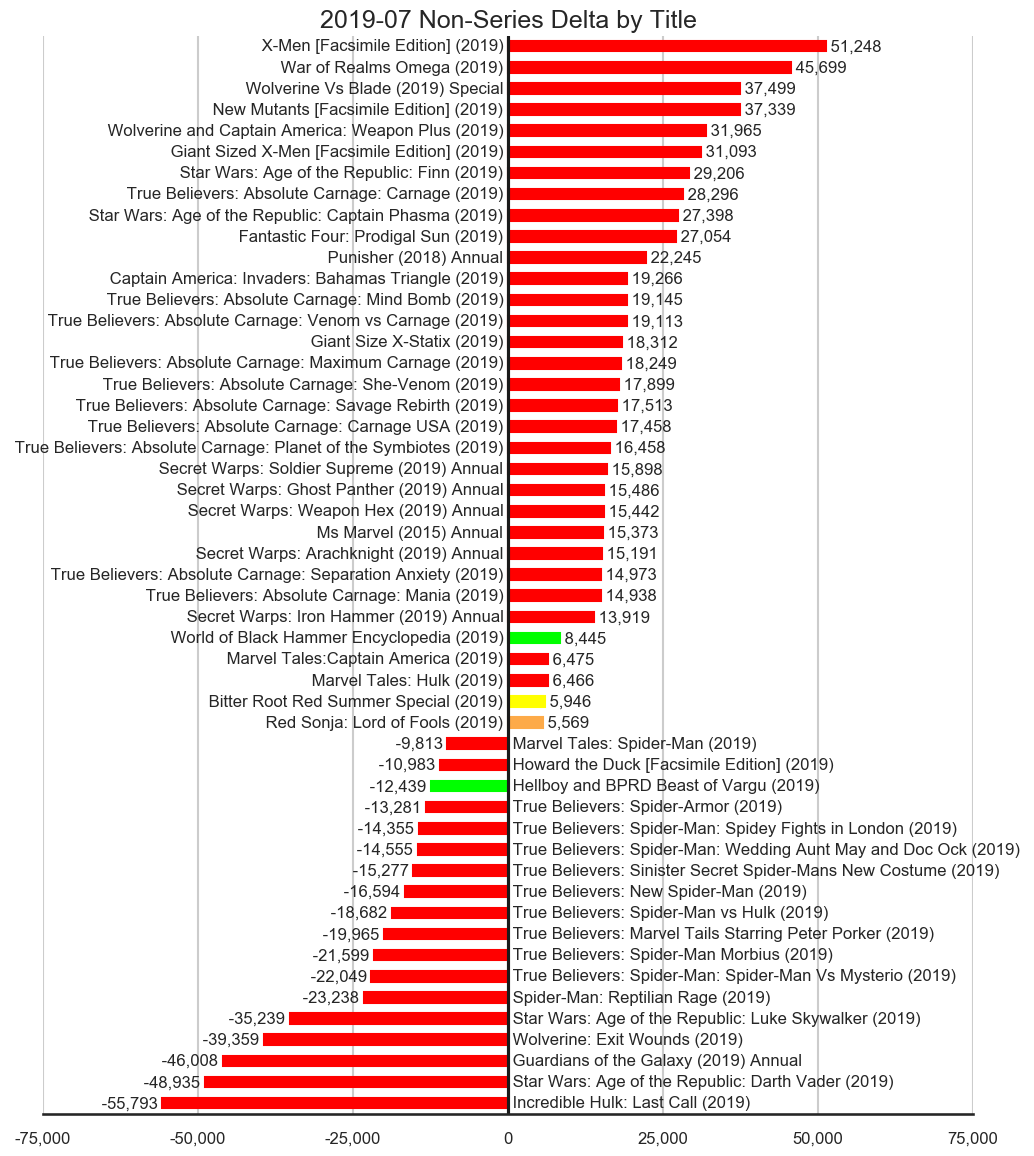

The 51 titles across the 4 publishers in the non-series category accounted for 686,576 units in the top 300 comics with an upswing of 686,576 units, a downswing of 438,164 units for a net an increase of 248,412 units.

Marvel continues to dominate in this category and accounted for 97.09% of the upswing and 97.16% of the downswing in this category.

The 18 titles across the 3 publishers in the reorders category accounted for 97,172 units in the top 300 comics with an upswing of 97,172 units, a downswing of 190,640 units for a net a decrease of 93,468 units.

Marvel Comics accounted for 72.89% of the change in this category. Venom Annual accounted for -47.11% of the change in this category. There was still some reorder activity for Immortal Hulk between ranks 301 and 500 but only 2,750 for Immortal Hulk #18 and 2,271 units for Immortal Hulk #19. The cooling off on reorder activity for Immortal Hulk makes sense given the Immortal Hulk: Director's Cut title and three trade paperbacks for the series.

The big news in July was the surprise ending of Walking Dead. Some The question of how that might impact Image Comics is worth considering. The first thing to keep in mind is that Image Comics neither owns nor produces Walking Dead, they just publish it. Image does no better or worse based on how Walking Dead or any other Image title sells. The creators or studio that produces a given title are the ones that benefit from the success of a title.

As for how the loss of sales from the Walking Dead will impact the total units for Image Comics on these charts, obviously the loss of the strongest title will be felt. Walking Dead was the publisher's best success stories and demonstrated that a comic series could come out of nowhere and increase sales over time and get to the upper end of the sales charts. But it isn't going to fundamentally change things for Image since it was just one title out of the many published by Image every month.

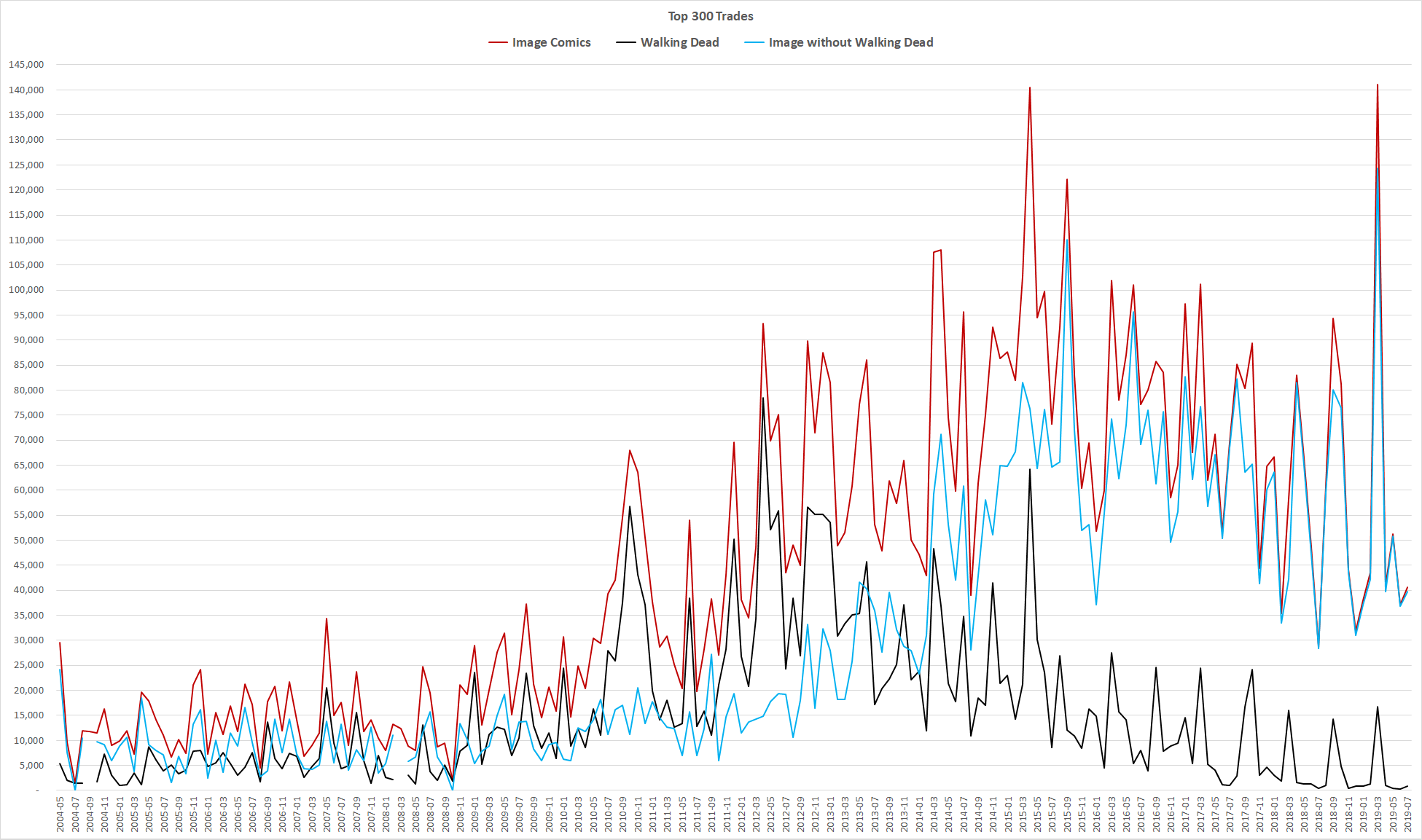

Here is a chart of the monthly sales of the top 300 comics sales for Image Comics, Walking Dead and Image Comics with Walking Dead since the launch of Walking Dead in November 2003:

The dark red line is the total sales for all of Image Comics, including Walking Dead. The black line is the sales of Walking Dead in the top 300 comics. The light blue line is how Image Comics would have done without Walking Dead. The three spikes correspond to issues which had variant covers such as Walking Dead #100 and Walking Dead #115. Obviously the sales for Image go down if any given title is excluded from the total. The point is the Walking Dead comic book series wasn't a make or break title for Image in terms of unit sales.

Looking at the trades list starting with the release of the first Walking Dead trade in May 2004 paints a different picture. For a number of years, Walking Dead was a major component of the top 300 trade sales for Image Comics. But as time moved on and the blacklist of trades for Walking Dead got longer and longer, the overall sales for Walking Dead in the top 300 cooled off and became a smaller and smaller part of the overall trade sales for Image Comics. Ironically, a lot of that can probably be credit to Robert Kirkman who both proved in can be profitable for a creator to publish through Image and actively recruited creators to Image. Also, the sales of Walking Dead trades and hardcovers most likely just fell under the radar of the top trades list released by Diamond. I have no doubt that the full picture of the Walking Dead sales, both through Diamond and in the mass market which this data doesn't cover, is still robust and will likely remain that way for a while.

Regardless of the financial or sales impact of Walking Dead ending, it does change things in terms of look at comic book sales. The series was a successful title amid the sea of titles slowly dropping in sales each and every month. The series gained sales by telling a compelling story without having to resort to incentive covers every month or renumbering or retitling the series after every few story arcs. The property went from not existing to being a well known part of our entertainment culture. It is one of the few major successful new properties to come out of comics far too long.

For a more in-depth discussion of the sales data, check out the Mayo Report episodes of the Comic Book Page podcast at www.ComicBookPage.com. The episode archived cover the past decade of comic book sales on a monthly basis with yearly recap episodes. In addition to those episodes on the sales data, every Monday is a Weekly Comics Spotlight episode featuring a comic by DC, a comic by Marvel and a comic by some other publisher. The podcast covers a wide variety of the comics currently published. If you are looking for more or different comics to read, check out the latest Previews Spotlight episode featuring clips from various comic book fans talking about the comics they love. With thousands of comics in Previews every month, Previews Spotlight episodes are a great way to find out about new comic book titles that may have flown under your comic book radar.

As always, if you have any questions or comments, please feel free to email me at John.Mayo@ComicBookResources.com.