In April 2015, with the exception of "Batman," none of the top ten items were ongoing superhero titles from DC or Marvel. The top 300 comics gross a total of $33,720,189.82 at full retail price in April 2015 making it the top grossing month for the top 300 comics since the final order era began in March 2003. It was also the second highest total number of units for the top 300 comics with 8,387,834 units putting it just 21,246 units behind the October 2014 which hold the record with 8,409,080 units.

It was a similarly strong month on the top 300 trade list with the aggregate unit sales setting a new record of 447,875 units and the second highest total retail dollar amount of $9,011,718.59 putting it about $1.5 million behind December 2013 which had a total of $10,509,701.54 for the top 300 trades at full retail price.

Setting such records is particularly interesting in light of April starting a period of time when the ongoing superhero titles from Marvel and DC are going on hiatus for a few months. DC put the New 52 line on hiatus for April and May as they moved from New York to Burbank, using the Convergence event to bridge that gap. Next month, the majority of the ongoing Marvel Universe titles take a leave of absence for the duration of the Secret Wars event. DC had the majority of the top ten slots between the first five weekly issues of "Convergence" and the delayed "Batman" #40. The remainder of the top ten went to Marvel thanks to the various Star Wars titles, with "Star Wars" #4 topping the list with 203,817 estimated units.

"Star Wars" #4 not only topped the list but also outsold the previous two issues of the series. An increase on a fourth issue is generally a very good sign and it is likely the heavy promotion of the first issue, which included being distributed in LootCrate, is responsible for this 26.52% increase in sales over the third issue.

Another notable increase in sales for Marvel was "Deadpool" #45, which sold 96,897 units an increase of 143.97% over the sales of the previous issue. The issue was a giant sized 250th issue celebration of the character and also the end of the series. The character has been successful in recent years and with the upcoming movie, it is almost a certainty the character will get a series after the Secret Wars event is over.

"Spider-Gwen" #3 sold 102,234 estimated units, which is much stronger than I expected. "Silk" #3, on the other hand, dropped another 15.3% selling around 58,755 units. "Spider-Woman" #6 sold 32,041 units which was a drop of a hair over 20%. "Ms Marvel" #14 sold a bit better than "Spider-Woman." "Superior Iron Man" #7 sold 34,440 units and "Superior Iron Man" #8 dropped over 7% down to 32,006 units. "Ant-Man" #4 not far behind it with 31,637 units. On the one hand, we have three female Spider-Verse characters competing against each other for sales in that niche, and on the other hand, we have two characters featured in the Marvel Studios movies. After three solo movies and two Avengers movies, Iron Man isn't doing much better than Ant-Man, which has his movie just around the corner.

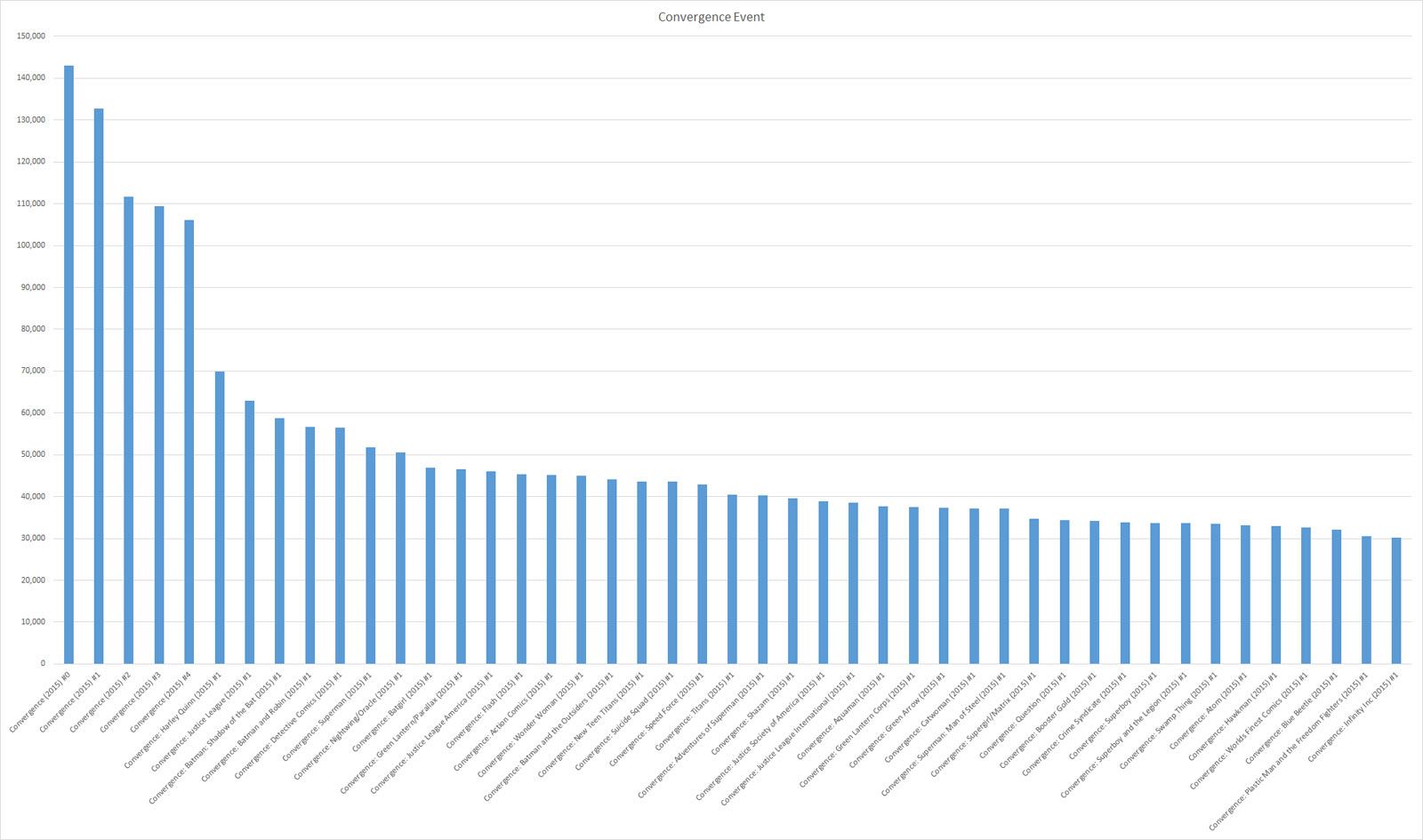

Overall, DC did very well in April with 3,219,015 total units for the top 300 comics, with 2,273,614 units of that coming from the Convergence Event. All five issues of "Convergence" sold over 100,000 units while the various related miniseries sold far less. This is typical and unsurprising. The nature of this event made it exceedingly challenging for retailers to accurately order and while the main miniseries might be selling well at comic book shops, it is questionable how well the related miniseries are selling at shops.

The main "Convergence" miniseries sold between 143,053 units and 106,131 units with each issues selling less than the previous into retailers.

The drop in sales over the issues of "Convergence" reflects how the retailers expected the miniseries to do, not how it sold for them. The risk with the Convergence event is to the retailers, not to the publishers, and the sales data from Diamond reflects sales from publishers to retailers. If the retailers misjudged the demand, which is a very real possibility, then the retailers get stuck with unsold items. If this causes retailers cash flow problems, that in turn impact the publishers in the coming months as the sales of other items are capped by how much the retailers can afford to spend. It is also very possible retailers might decrease orders on later Convergence related miniseries using the final order cut off process.

"Multiversity" #2 sold 54,275 units, which is down 40% from the first issue of the series of one-shots. Frankly, as a reader, I'm confused about the long term prospects of the DC Multiverse. This series seemed to be setting it up, yet "Convergence" seems to be geared towards moving back to a single universe. Some readers might not care about things like that or continuity, but some readers, such as myself, enjoy those aspects of comic book storytelling.

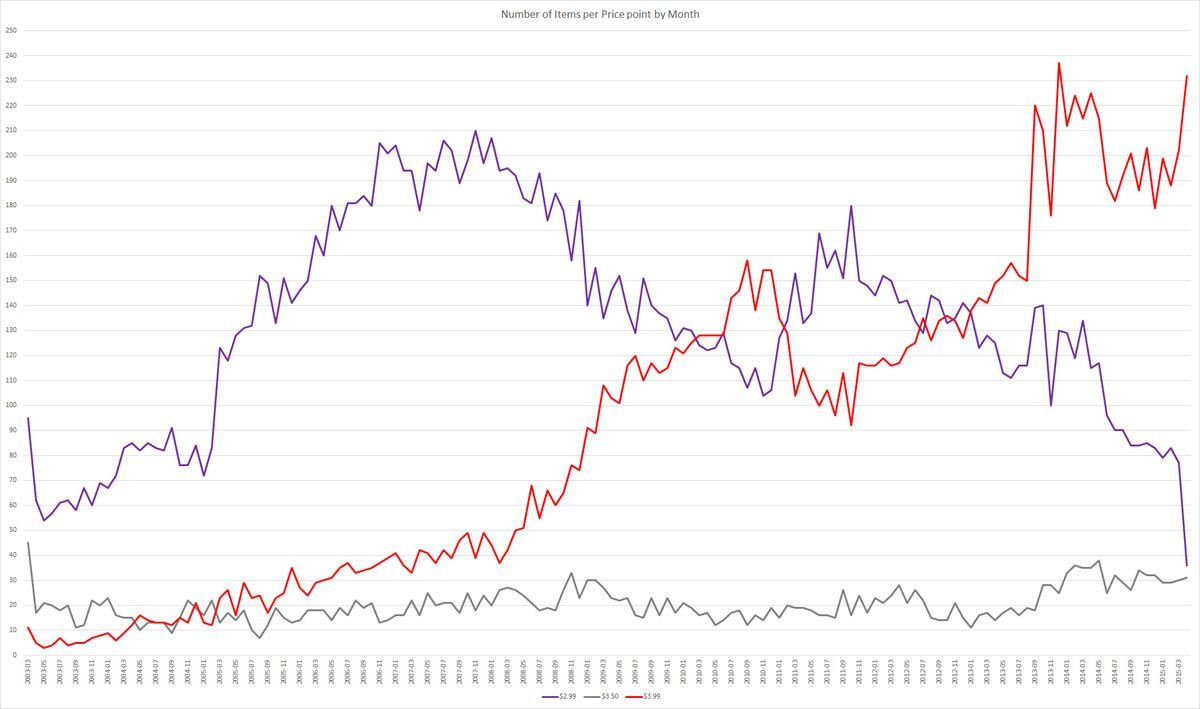

One trend that is very obvious if you look at a larger time slice than just a month-to-month comparison is how the cover prices are changing. Looking just at the count of items at the $2.99, $3.50 and $3.99 price point over the final order era which began in March 2003, we can see the dramatic increase of items at $3.99 along with a sharp decrease in items at $2.99.

Price increases are nothing new, but there has been significant resistance to the $3.99 price point over the past few years. The drop in the number of items at $3.99 in early 2011 shows how publishers backed off a bit from that price point during 2011. What is troublesome is the relative stability in number of items at the $3.50 price point. Publishers generally aren't taking incremental price hikes but are jumping from $2.99 to $3.99 in a single step.

Higher cover prices clearly contributed to April 2015 being the top grossing month but it is worth noting that unit sales haven't suffered as a result. At some point comics are going to be generally considered too expensive for the amount of content they contain and sales will drop. Some people already think that and it is a difficult viewpoint to argue against.

I'll be on vacation next month, so the data and article will be delayed a few weeks until the end of June.

If you'd like to listen to an in-depth discussion of the sales data, check out the Mayo Report episodes of the Comic Book Page podcast at www.ComicBookPage.com. In addition to those episodes, every Monday is a Weekly Comics Spotlight episode featuring a comic by DC, a comic by Marvel and a comic by some other publisher. I read around 200 new comics a month so the podcast covers a wide variety of what is currently being published. If you are looking for more or different comics to read, check out the latest Previews Spotlight episode which features clips from various comic book fans talking about the comics they love. With thousands of comics in Previews every month, Previews Spotlight episodes are a great way to find out about things which may have flown under your comic book radar.

As always, if you have any questions or comments, please feel free to email me at John.Mayo@ComicBookResources.com.