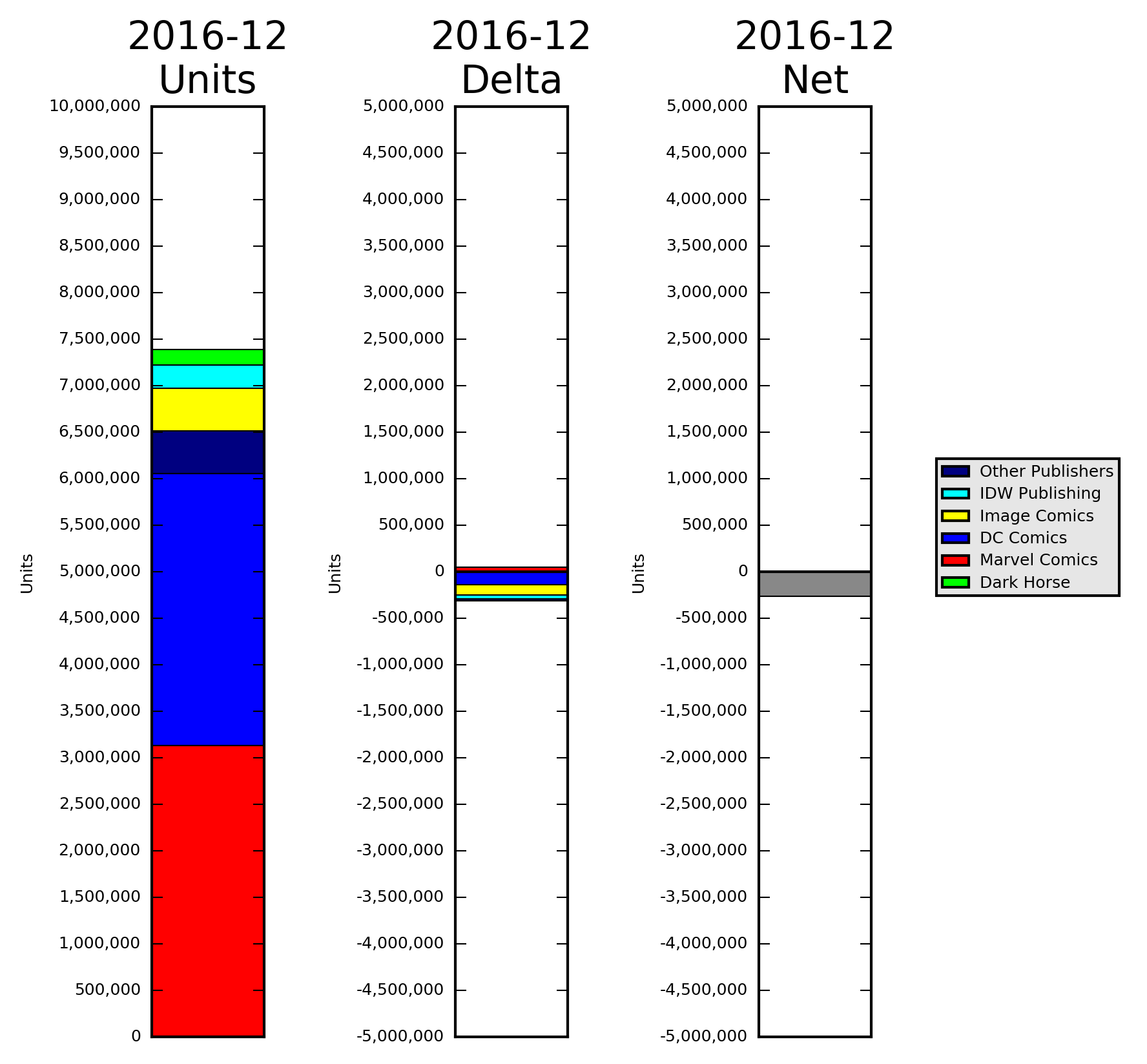

December 2016 had 7,385,610 units in the top 300 comics list, a drop of 265,293 units from last month. Marvel placed 3,135,240 units on the top 300 comics list accounting for 46.2% of the units. DC wasn't too far behind with 2,917,860 units accounting for another 29.51% of the total units for the top 300 comics. The other premiere publishers, Image, IDW and Dark Horse, account for another 11.77% of the units sales with a combined total of 869,195 units. Another 17 publishers placed items on the top 300 comics list with a combined total of 463,315 units accounting for the remaining 6.27% of the units for the top 300 comics.

The top ten was split between Marvel and DC, with both companies having five of the ten items. The top five was mainly DC titles with a single Marvel item. For the top ten items, DC had 605,977 units and Marvel had 566,801 units. The reasonably even split in the top ten, 51.67% for DC and 48.33% for Marvel, indicates strong interest in material from both of the two major publishers.

"Justice League/Suicide Squad" #1 topped the list with 179,643 units, but the miniseries dropped by 54.08% down to 82,485 units on the second issue. Some people are considering this an event title. Personally, I don't since it isn't a storyline involving a majority of the titles in the line. Either way, it is selling well and readers seem to be enjoying it, which is good for DC.

"IvX" #1 and "Civil War II" #8 were the best sellers for Marvel, followed by "Star Wars" and "Star Wars: Doctor Aphra," indicating the main items of interest at Marvel are the event titles and Star Wars. The best selling comic from Marvel which wasn't an event title, part of the Star Wars property or a first issue was "Invincible Iron Man" with 81,271 units, down 16.83% from the first issue. The next such item is "Avengers" #2 with 64,289 units, up 55.82% from the "Avengers" #1.1 issue which sold 41,258 units but down 21.49% from the 81,884 units of "Avengers" #1.

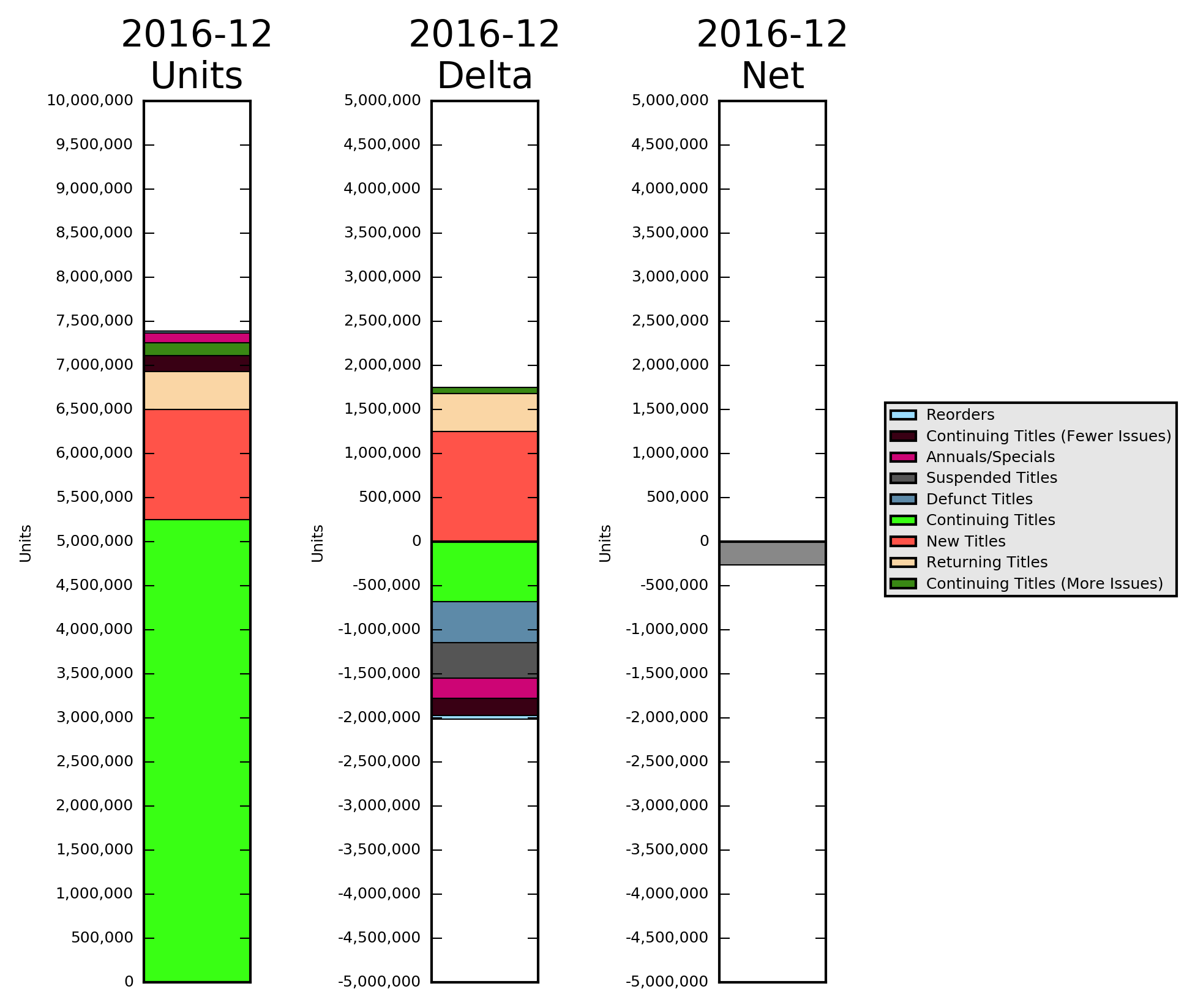

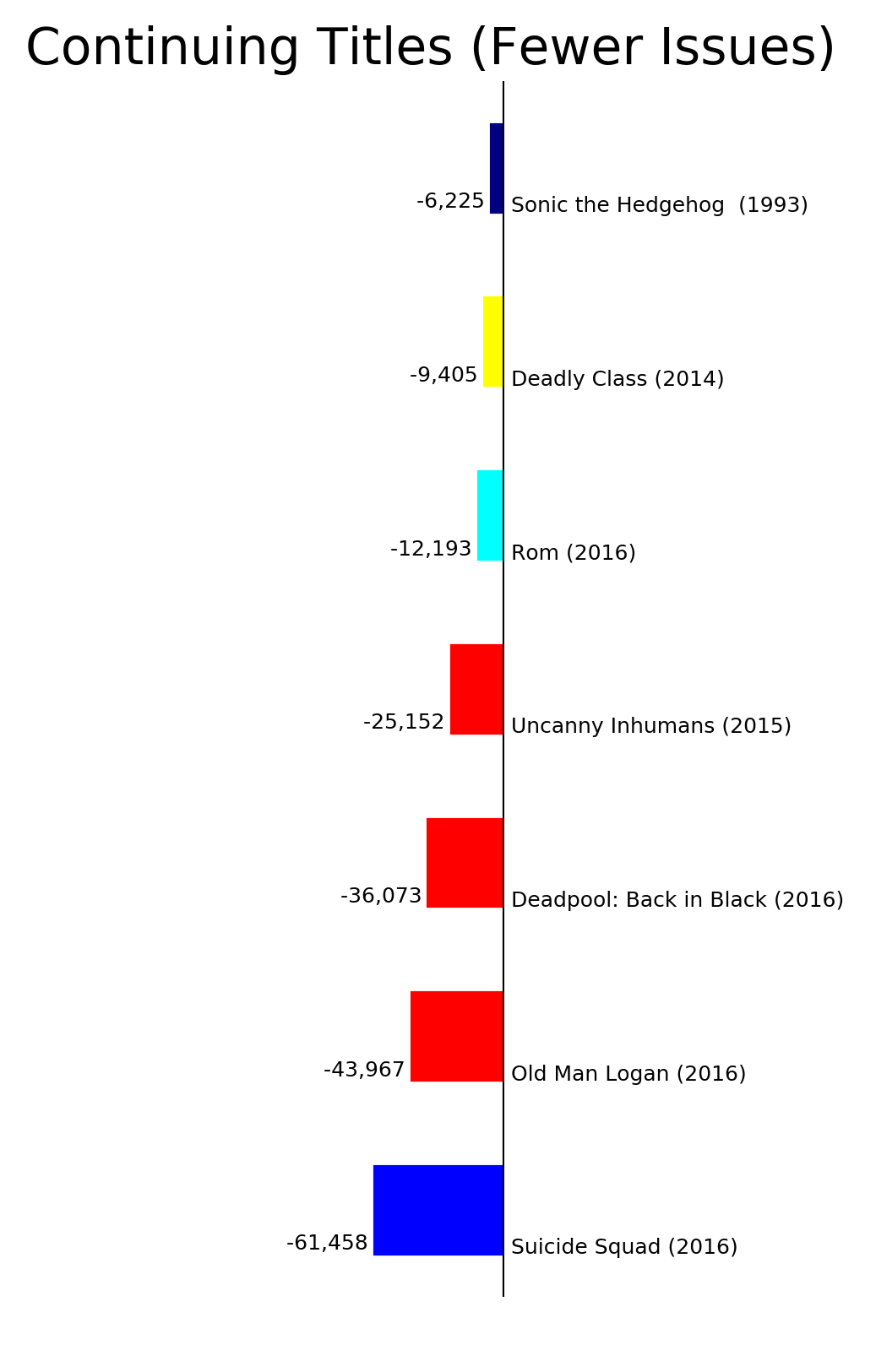

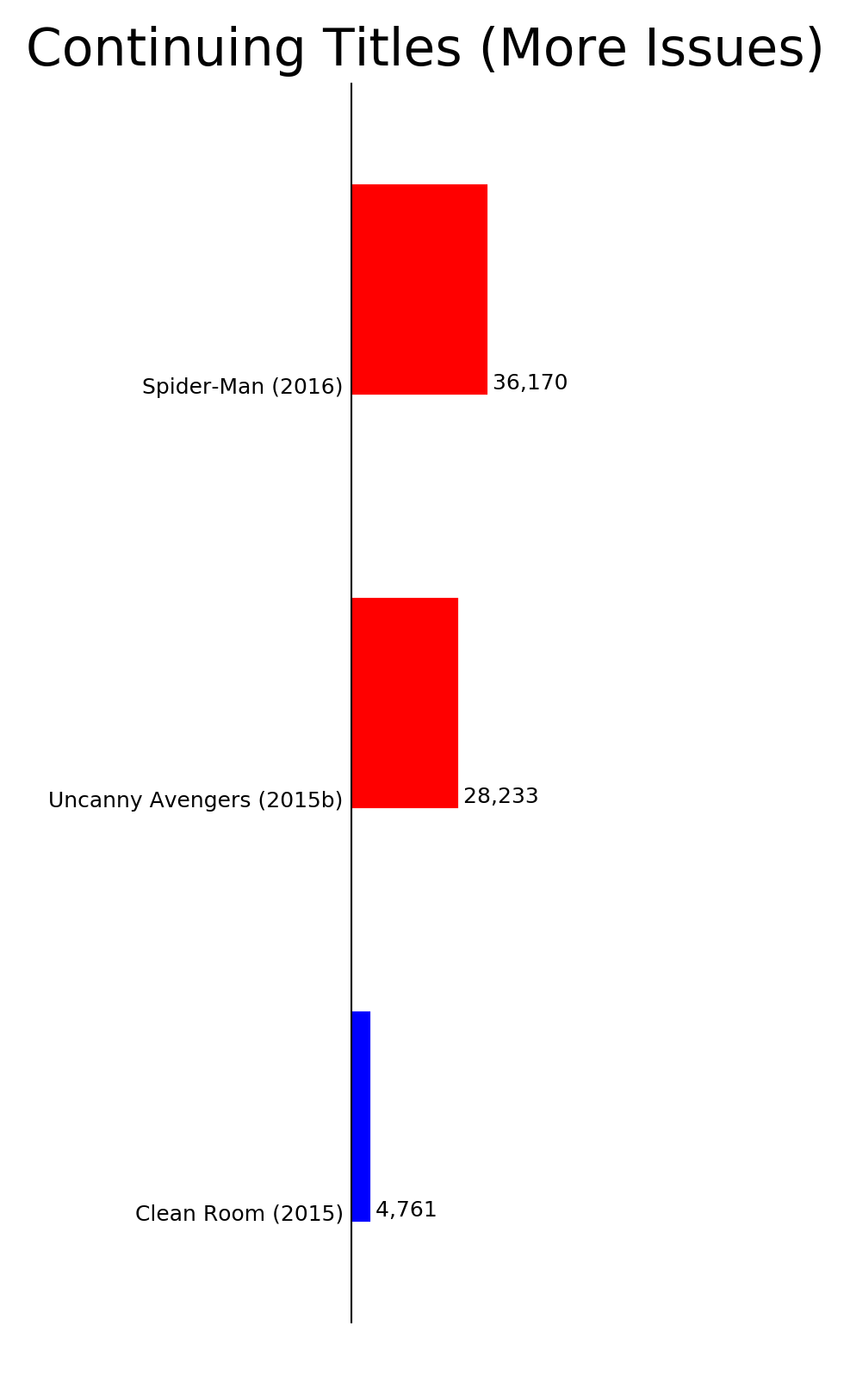

As should be expected, the continuing titles (titles which shipped last month and this month) formed the bedrock of comic book sales in terms of providing most of the units. This is the group that also is the source for the majority of the losses each month since ongoing title lose sales over time. I've added two new categories this month of "Continuing Titles (Fewer Issues)" and "Continuing Titles (More Issues)" since the number of issues released each month can influence determine if the total unit sales for a title increase in or decrease in sales even if the issue to issue trend is going in the opposite direction.

The first bar chart is the unit sales by category. The second is the month-to-month change in sales for the categories with the largest segments closest to the zero point on the y axis in either direction. The third chart is the net change in sales from last month. The decrease in sales of continuing titles, missing sales from suspended titles and sales lost because of titles which ended last month overwhelmed the increases in sales from continuing titles, new and returning titles for a net loss of 265,293 units.

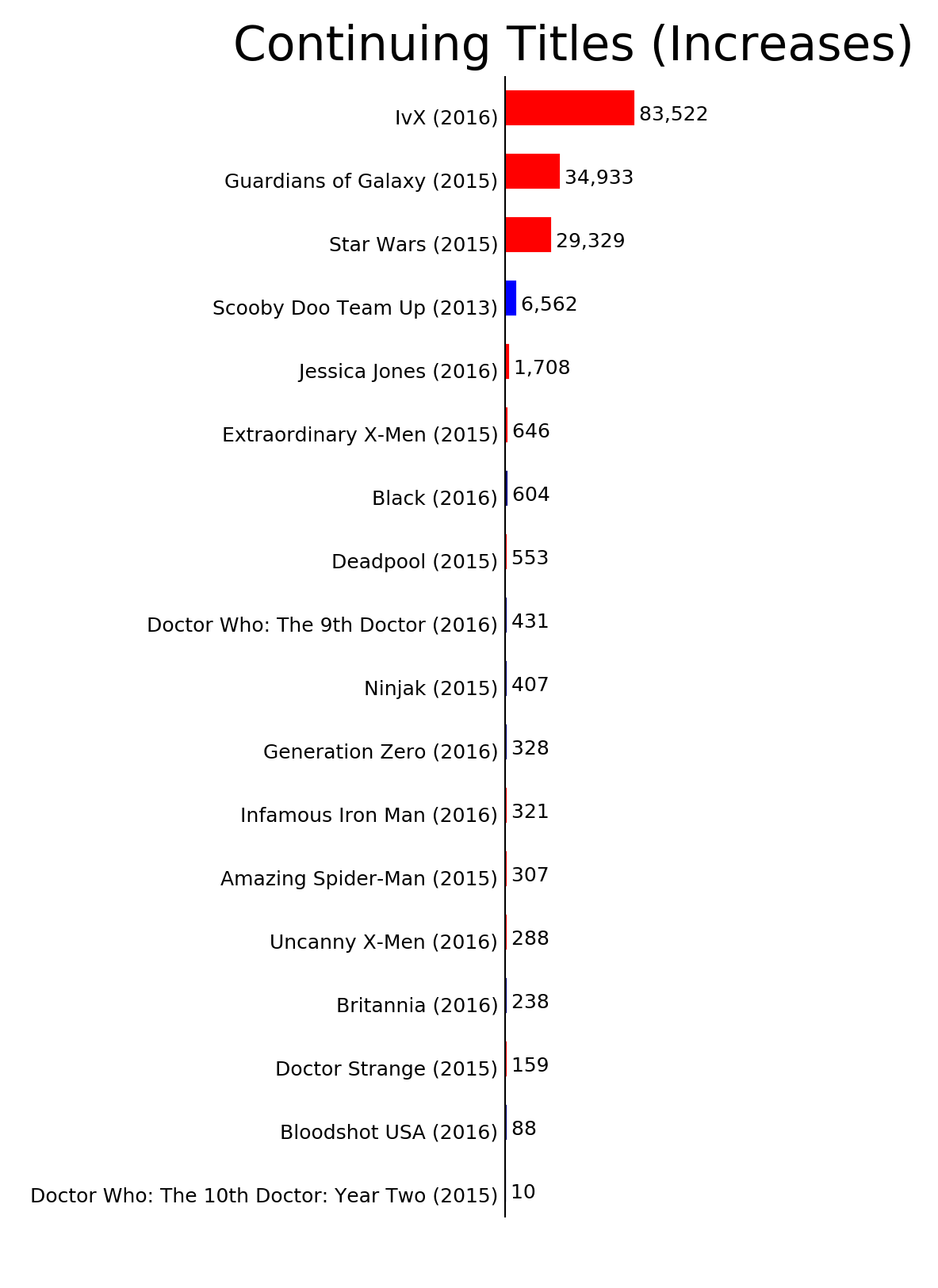

In the future, I might split the Continuing Titles group into two groups, one for titles increasing in sales and titles decreasing in sales. The impact of that would most likely be the "Continuing Titles (Decreasing)" would have a larger negative impact than the current "Continuing Titles" group has since the "Continuing Titles (Increasing)" group is included in it and is counter-acting some of the decrease in sales. I'm already breaking those groups out in the horizontal bar charts below so making that change won't be difficult.

Looking at the sales of the top 300 comics by publisher, we see Marvel and DC are the bulk of the sales as expected. The other three premiere publishers and the group of all of the publishers in the back half of Previews contribute a visible amount to the sales of the top 300 comics. Marvel had an increase of 48,430 units which is surprisingly low given the over-shipping they did in December.

A good way to discover items which were over-shipped or otherwise heavily discounted is to compare the retail ranking for the title against other titles at the same price point. When doing that, keep in mind that the publishers in the back half of Previews generally can't offer stores the same discounts as Marvel and DC, and the retail ranking is based on the number of units, the cover price and the retailer discount for each item. Over-shipping/discounting offers an explanation how "IvX" #1, with a cover price of $5.99 and estimated sales of 167,703 units, had a retail ranking of 3, indicating it brought in fewer invoice dollars than "Dark Knight III: The Master Race" #7, which had a retail ranking of 2 with estimated sales of 119,114 units at that same $5.99 cover price. Since we know the cover price of the two items and can estimate the sales of them from the order index values provided by Diamond, the only thing which could explain the otherwise unexpected retail ranking is the discounts on the items. Over-shipping more units for free effectively acts as a discount on the total orders received.

Hopefully Marvel is just trying to get more comics into the hands of readers and isn't trying to game the sales reporting system with the over-shipping.

The horizontal bar charts below are color coded by publisher in accordance to the the titles on the horizontal bar charts by publisher. Marvel titles are in red, DC in blue, IDW in cyan, Image in yellow, Dark Horse in green and the other publishers in purple.

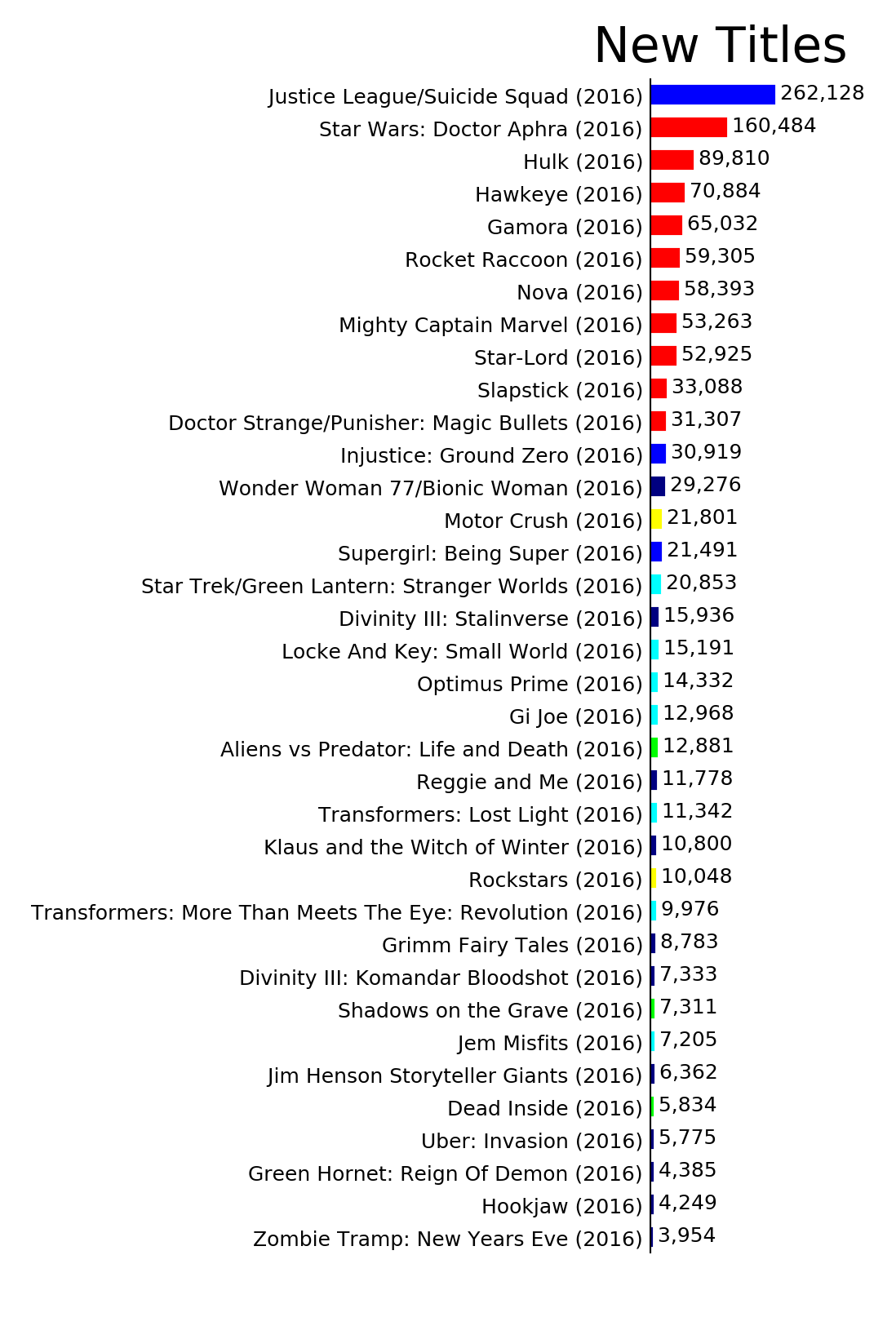

New titles added 1,247,402 units to the list which weren't on the list last month.

"Justice League/Suicide Squad" was the winner here, with two of the six issues released in December. "Star Wars: Doctor Aphra" was the big relaunch launch from Marvel with the title replacing the "Star Wars: Darth Vader" title. We can also see the wave of new titles from Marvel in December. Most of them are relaunches of previous titles. This constant rotation of titles forces a sales churn at the reader level. Each time a title relaunches, it forces a decision point for each reader if they continue to the new volume. This is a decision point which exists with each issue of an ongoing title but the key difference is relaunching/revoluming a title forces the decision on a much more conscious level.

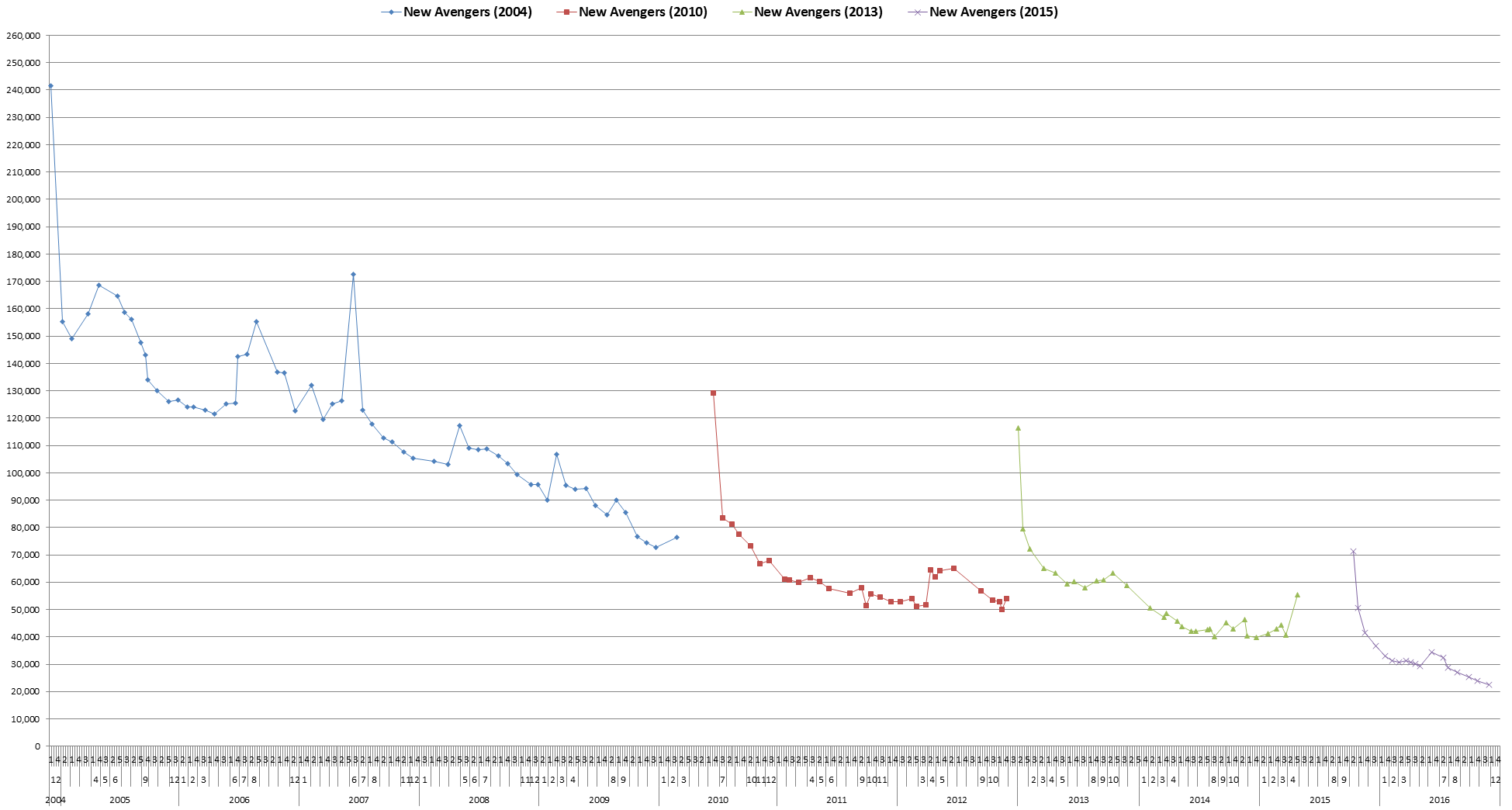

The high profile launch of a new volume can boost sales but if the new volume is somehow inherently different than the previous volume, sales of the new volume are likely to gravitate back to the sales of the old volume fairly quickly. Case in point, "US Avengers" #1 came out on January 4th, 2017 and will be included in the next set of numbers. The state cover gimmick is likely to put that title at or near the top of the charts. But it is just a continuation of the "New Avengers" title which ended in December. Based on this chart of how the various "New Avengers" volumes have been selling, how do you think the sales of "US Avengers" titles will be a few issues into the new volume?

The safe bet is somewhere in the 20,000 to 30,000 unit range, probably between 23,000 and 25,000 units by around the sixth issue. But, who knows, maybe the new title featuring mostly the same characters by the same creative team as the previous run of "New Avengers" will do better for some reason.

Again, I decided to break out the continuing titles which sold less because fewer issues were released from those decreasing in sales from month to month. This will generally be a short list as this month illustrates. This category represents sales of 180,284 and a perceived loss of sales of 194,473 units from last month because of the few issues shipped.

The list of titles shipping more issues than the previous month will also be a short list most months. The category added 69,164 units to the total in December over what these titles sold in last month. In December, only three titles fell into this category. Given the release cadence of many titles, we'll probably see titles bouncing between the "fewer issues" and "more issues" categories, particularly those titles which release around 18 issue a year.

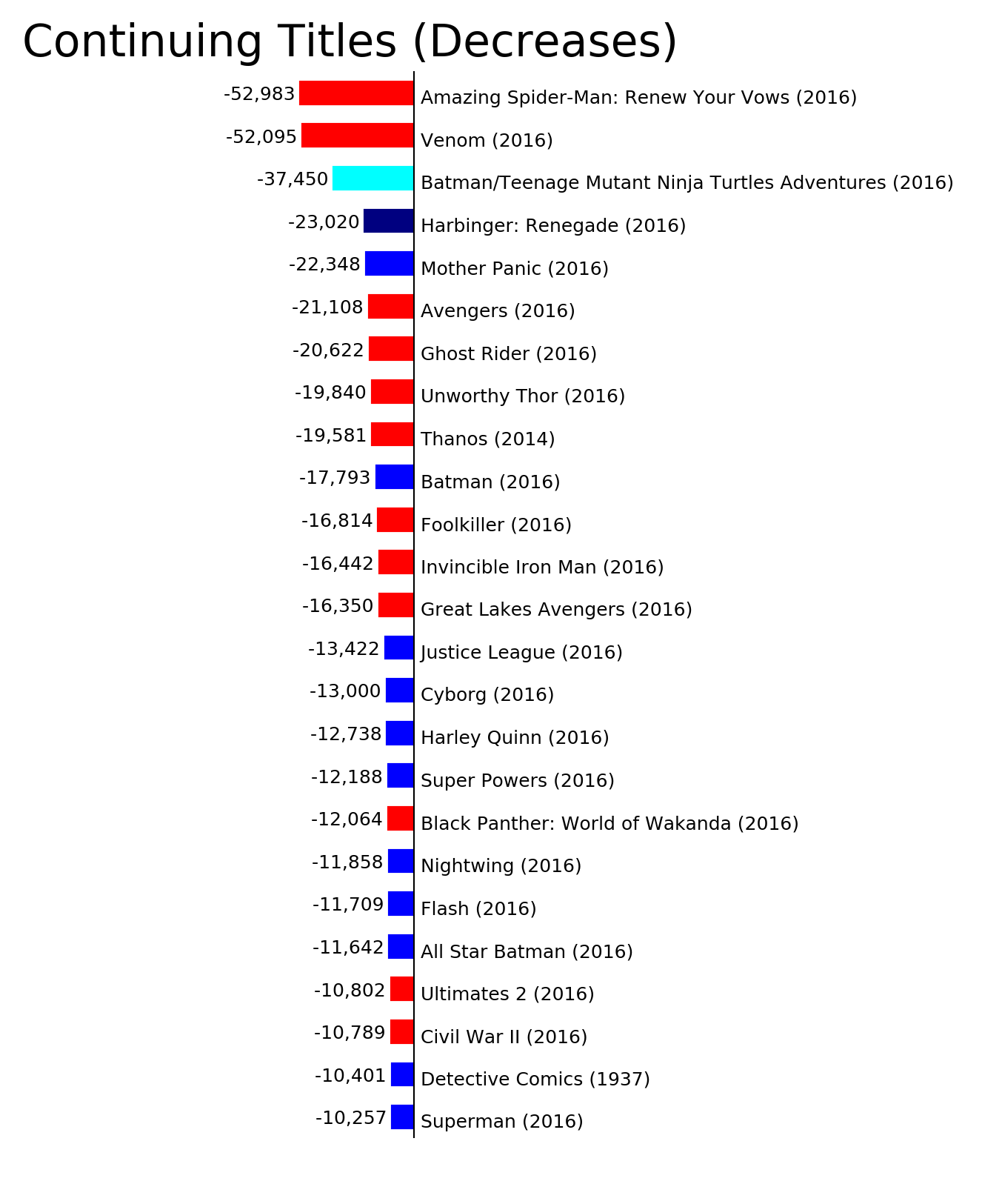

This next chart is filtered to drops over 10,000 units:

As is the case in most months, the majority of titles fall into the category of continuing titles which dropped in sales from the previous month. Since this charts is filtered to drops of over 10,000 units, it only represents 477,316 of the total 838,920 units in lost sales across the 167 titles in this category. The other 361,604 units are split across 142 titles which would make for a chart which is excessively long, unreadable or both.

The notable second issue drops this month include "Amazing Spider-Man: Renew Your Vows" #2 which dropped by 55.13%, around 52,983 units, to sell 43,128 units. "Venom" #2 dropped 57.79% from the first issue sales down to 38,043 units which is a loss of 52.095 units. "Harbinger: Renegades" #2 lost 73.43% of the first issues sales, dropping by 23,020 units down to sales of around 10,177 units.

The title with the smallest drop was "Mosaic" #3 which sold an estimated 31,671 units -- a drop of only 0.31%, roughly 97 units.

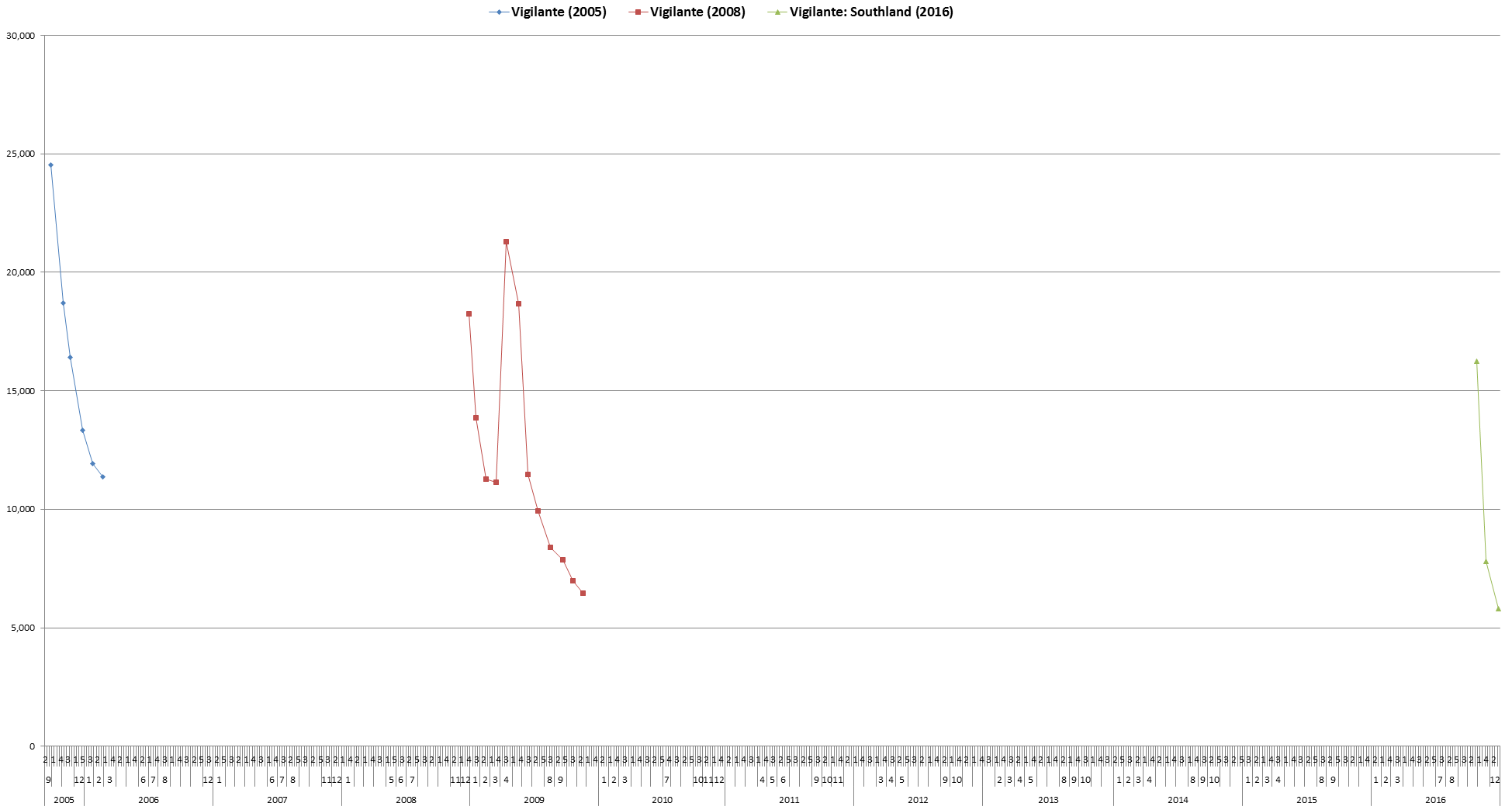

"Vigilante: Southland" #3 sold 5,801 units, dropping 25.5% from the previous issues sales. Since the drop is under 10,000 units, it didn't make the chart. DC has announced this six issue miniseries has ended with the third issue with the full six issues getting collected to trade. Here is a look at the sales of the previous "Vigilante" titles:

The chart shows the long gaps in time between the various "Vigilante" titles. The spike is sales on the 2009 volume was because of the "Deathtrap" storyline, which crossed over with the "Teen Titans" and "Titans" titles. What the chart can't show is that each of those titles featured a different Vigilante character. This current volume featured yet another brand new version of the character with no solid connection to any of the previous versions or to the DC Universe for that matter. With so many titles to pick from, this one apparently didn't make the cut for enough readers for DC to complete the miniseries. This is a dangerous thing for DC to do as it can lead to readers being hesitant to pick up miniseries in the fear they will buy some of the issues, the series will get aborted to trade and they'll have to buy the trade, including the cost of the issues they already bought, in order to get the full story. In this case, "Vigilante: Southland" was a $3.99 title. If the trade costs anything over the $11.97, the cover price the remain three issues would have cost, then readers are being forced to double dip in order to get the full story. From a reader perspective, the non-monetary content value of a completed story is considerably high than that of a half completed story.

The list of continuing titles increasing in sales is virtually always a shorter list. Only eighteen titles increased in sales in December over November. One of those increased by only about 10 units which is low enough to considered the sales effectively unchanged. The net increase in sales from this category was only 160,434 units with the top few items accounting for the overwhelming majority of it.

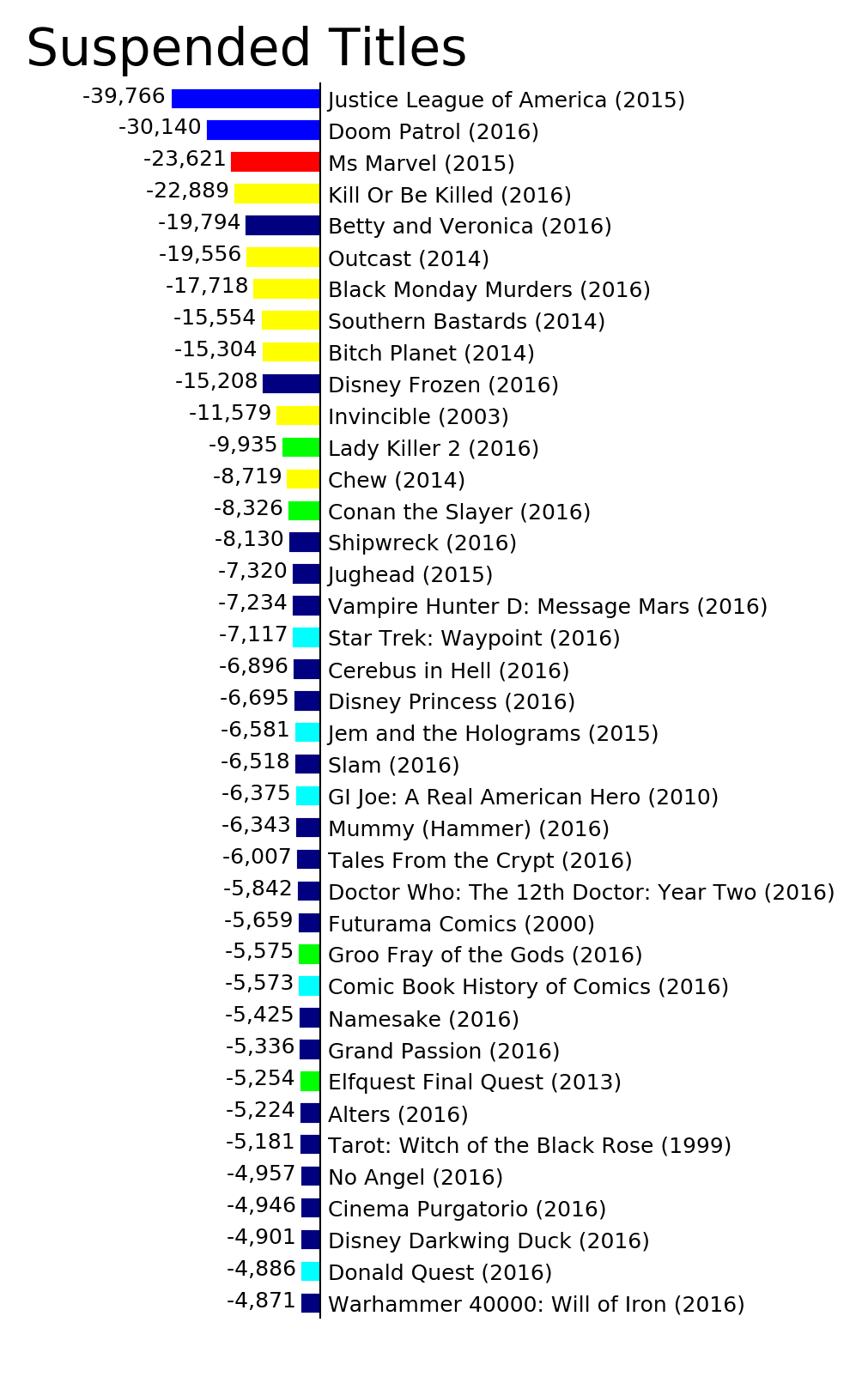

Titles which don't ship in a given month equate to lost potential sales during that month. This category represents a loss of 406,955 units which were around last month but not this month. Presuming these titles return next month, or at some point in the future, the sales aren't completely lost. For shops which are surviving on a week to week or month to month basis, this category can be problematic. Fortunately, there aren't any blockbuster titles in the category this month. Still, a loss of momentum on titles like the rebooted "Betty and Veronica" or the recently launched "Doom Patrol" isn't likely to help sales on those titles.

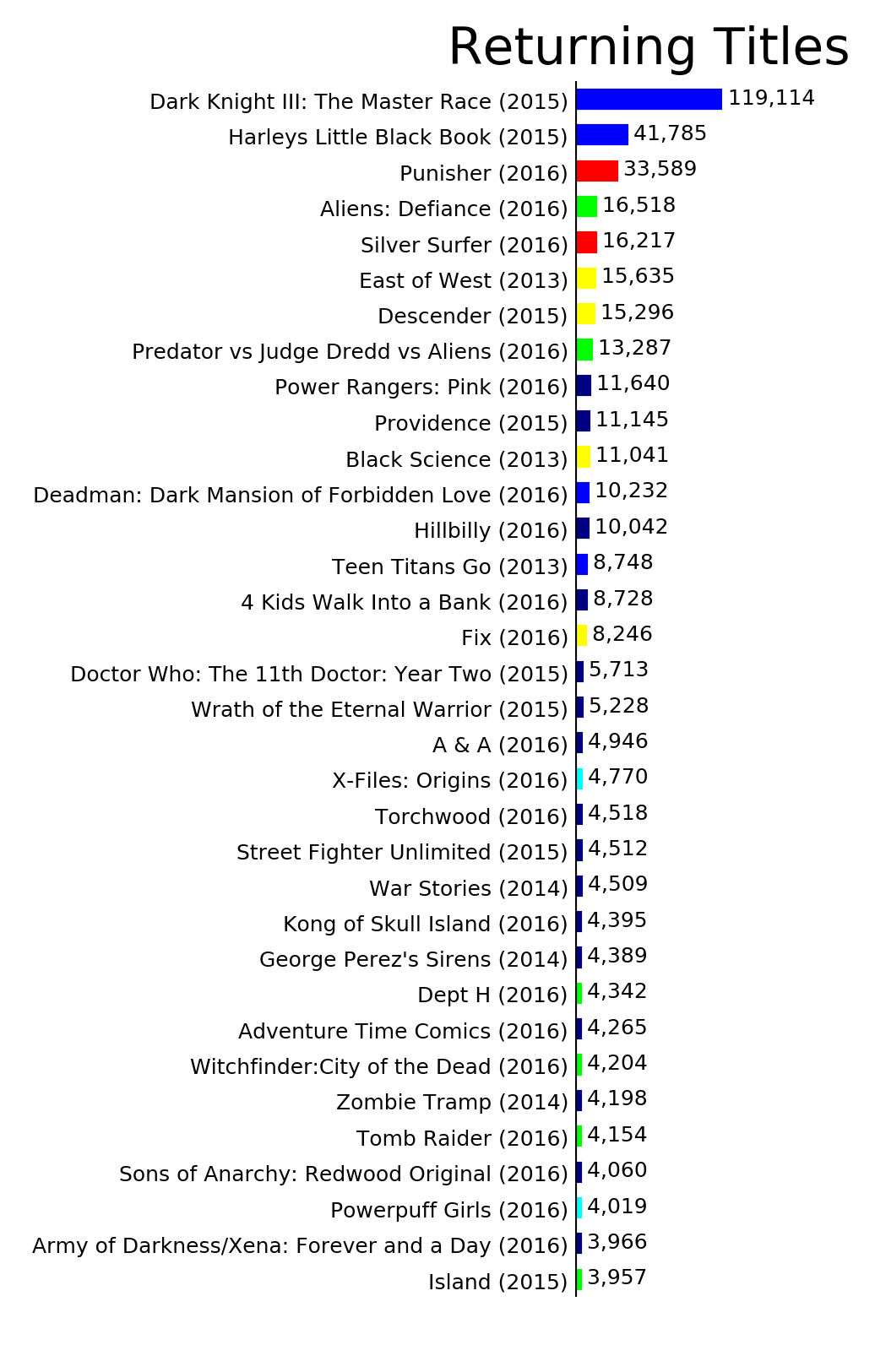

Returning titles accounted for an increase of sales over last month of 431,408 units resulting in a net increase of 24,452 units between the suspended and returning titles this month. Some of the titles which bounce between the suspended and returning categories are scheduled to be bi-monthly, others sometimes just run a little late and skip a month. The most notable in this category is "Dark Knight III: The Master Race" which accounted for 119,114 units of the 431,408 total for this category.

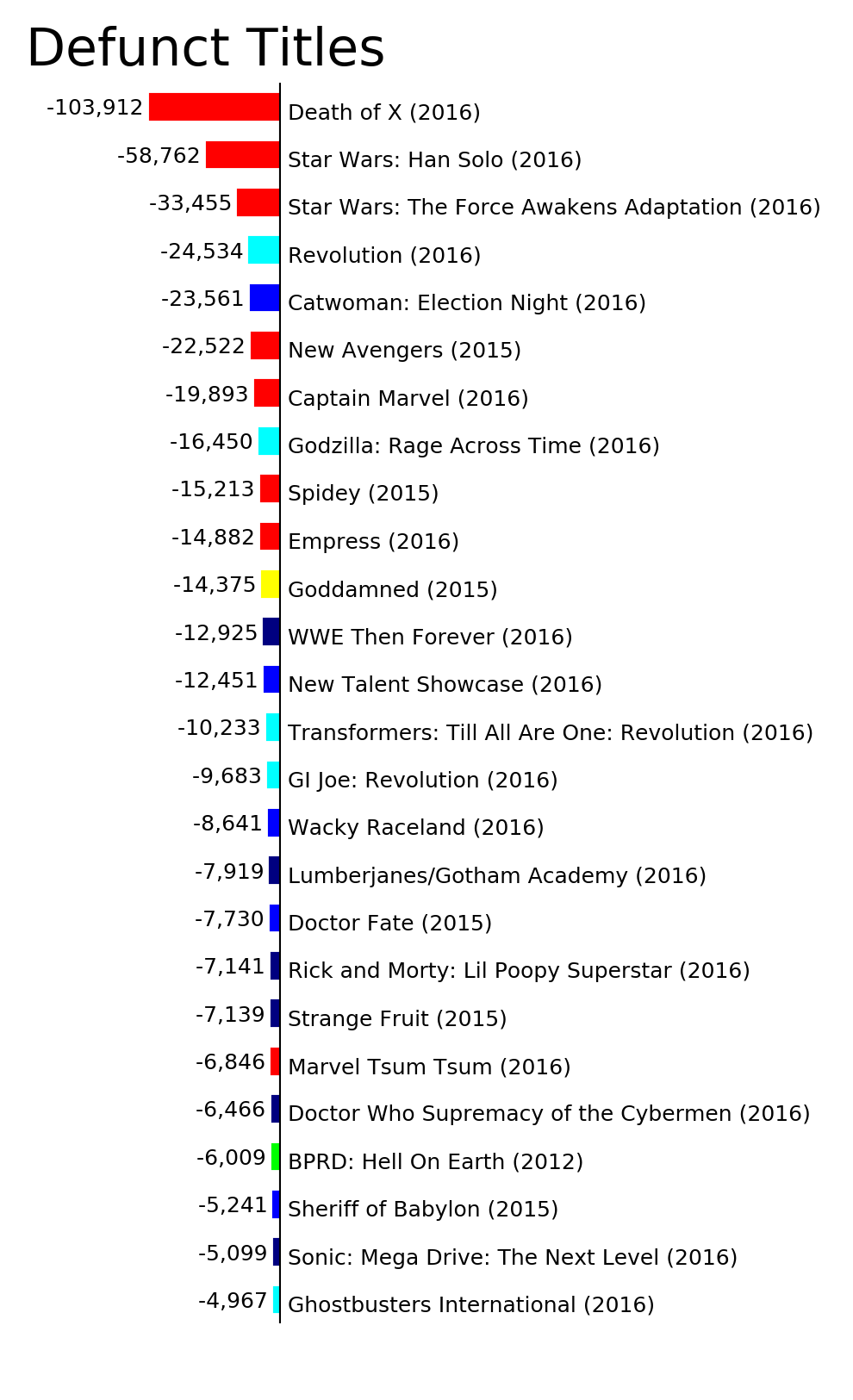

Defunct titles, those which ended last month, account for a loss of around 466,049 units. The top three items in this category, "Death of X," "Star Wars: Han Solo" and "Star Wars: The Force Awakens Adaptation" account for a loss of 196,129 units for Marvel in December. Other titles are ending and quickly being replaced. The loss of 19,893 units from "Captain Marvel" which ended last month is more than compensated for by the 53,263 units for "Mighty Captain Marvel" this month. As I mentioned above, this constant rotation of titles forces readers to reevaluate if they should continue getting titles which is a question that can only serve to lower sales.

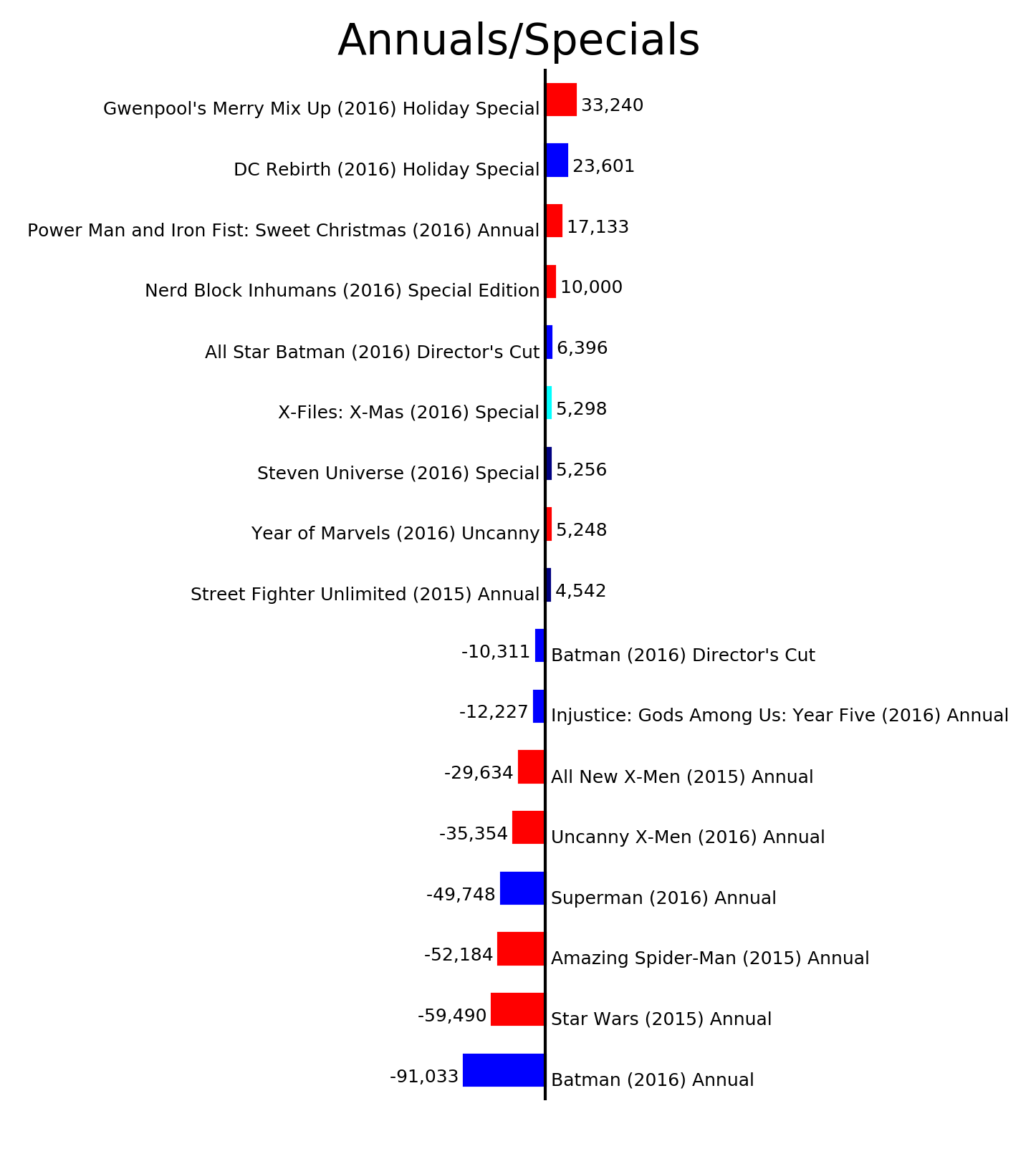

Roughly the same number of annuals, specials and the like shipped in November and December. The ones which shipped in November sold much better resulting in a loss of 2219,267 units in this category.

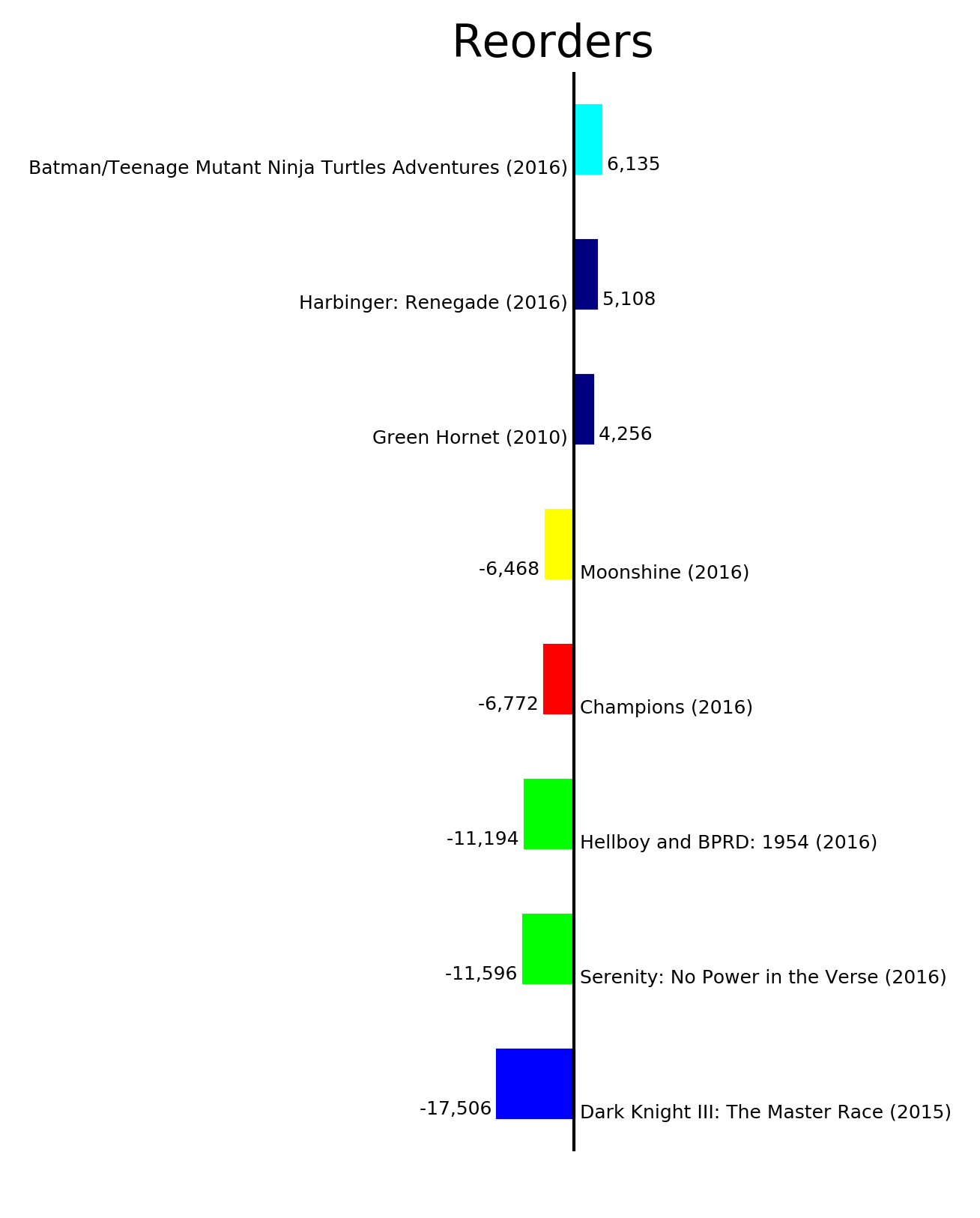

"Harbinger: Renegade" #1 had 5,108 units of reorder activity in December. This provides context for the second issue drop. Presumably the reorder activity indicates reader interest that, based on the second issue drop, the retailers might not have been expecting. This could be a good sign for the title.

While there was a lot of movement in December in many of the different categories, much of it was counter-balancing. A net drop of 265,293 is not bad and the second half of 2016 was very strong. Unfortunately, sales during the first quarter of a year are usually weak. DC is helping out with a strong miniseries, "Justice League vs Suicide Squad" and Marvel is releasing "US Avengers" with around 60 covers. Over at Image, Robert Kirkman is offering "The Walking Dead" #162 at $0.25 and it should be a great jumping point. Each of the major publishers is trying a different tactic to combat a soft first quarter.

As readers, the best thing you can do for your retailers is to communicate with them. Let them know what comics you like and don't like, which titles you are planning on buying and not buying. With the record breaking sales over the past few months, a lot of merchandise has gone into comic book stores. With increase sales into stores comes increased risk for those stores. Help your retailer out by providing them the information they need to order accurately. If your store has a pull and hold system you use, pick up your held items on a timely basis. If you can't afford to do so, be up front with your retailer about that and work something out. Everybody feels the financial pressure at the start of the year as they pay off the holiday spending or recoup from paying the year end property tax bill. I had a point in my life when my job suddenly ended and my comic book spending dropped considerably. One of the first things I did was let me retailer know. In order to have the record breaking sales we saw in 2016, we need strong retailers. As readers, we ultimately determine if the comic book retailers are healthy or not both by what we buy and by how we treat them.

For a more in-depth discussion of the sales data, check out the Mayo Report episodes of the Comic Book Page podcast at www.ComicBookPage.com. The episode archived cover the past decade of comic book sales on a monthly basis with yearly recap episodes. In addition to those episodes on the sales data, every Monday is a Weekly Comics Spotlight episode featuring a comic by DC, a comic by Marvel and a comic by some other publisher. I read around 200 new comics a month so the podcast covers a wide variety of the comics currently published. If you are looking for more or different comics to read, check out the latest Previews Spotlight episode featuring clips from various comic book fans talking about the comics they love. With thousands of comics in Previews every month, Previews Spotlight episodes are a great way to find out about new comic book titles that may have flown under your comic book radar.

As always, if you have any questions or comments, please feel free to email me at John.Mayo@ComicBookResources.com.