December 2015 was an above average month for Marvel, DC and the rest of the Direct Market, but not a record setting month like the previous two had been for Marvel. The total of 7,951,713 units for the top 300 comics was well above the average of 6,583,187 units and only about half a million units below the high water mark of 8,408,949 set in October 2014.

Marvel accounted for 47.03% of the total units for the top 300 and 48.98% of the total retail dollars. "Secret Wars" #8 topped the list with 169,66 units, down 4.15% from the previous issue. Given the ramifications of this miniseries on the Marvel Universe, there is a strong chance we'll see an uptick in sales on the final issue. "Star Wars" #13 was not far behind with 139,917 units, up 13.63%. "Guardians of Infinity" #1 sold 121,406 units into retail stores and was the only other Marvel title over 100,000 units.

December Sales Charts: "Secret Wars" Tops December Sales, "Star Wars" Enjoys "Vader Down" Bump

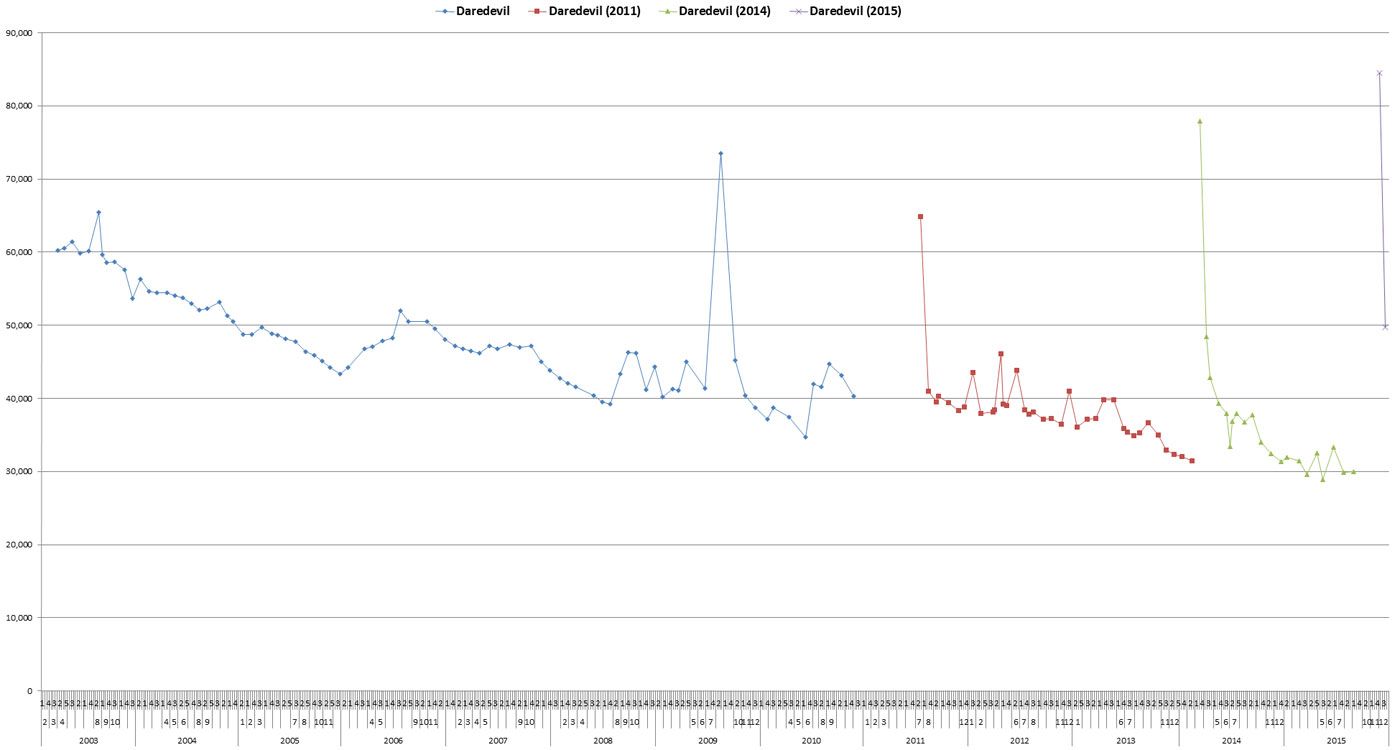

The latest "Daredevil" #1 sold 84,499 units compared to the 29,945 units the previous volume ended at. That previous volume started at 77,953 units and the volume of "Daredevil" before that started at 64,866. Clearly on this property, the relaunches have resulted in highest first issue sales for the past few volumes. In the case of the 2011 volume of "Daredevil," aside from the first issue the sales trend immediate fell back in line with the sales of the previous volume. For the 2014 volume, the sales trend after the first arc was a little better but not all that different from the sales trend for the 2011 volume.

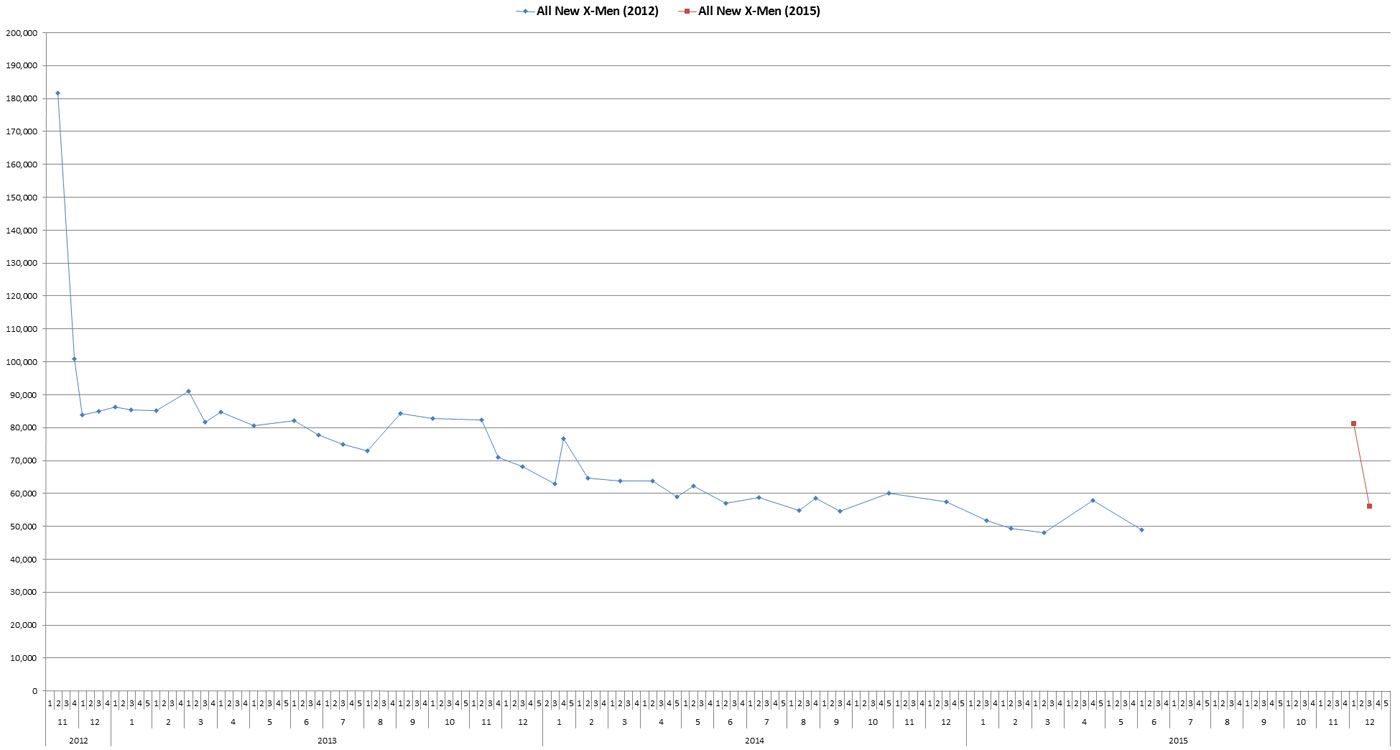

"All New X-Men" #1 sold 81,341 units. The previous "All New X-Men" #1 from 2012 sold 181,692 units, and that volume ended around 48,937 units. "All New X-Men" #2 (of the new volume) also shipped in December dropping 30.95% to 56,168 units. The second to last issue of the previous volume sold 57,796 units. In this case, the new volume relaunched with less than half the units and seems to have immediately fallen back in line with the sales trend of the previous volume.

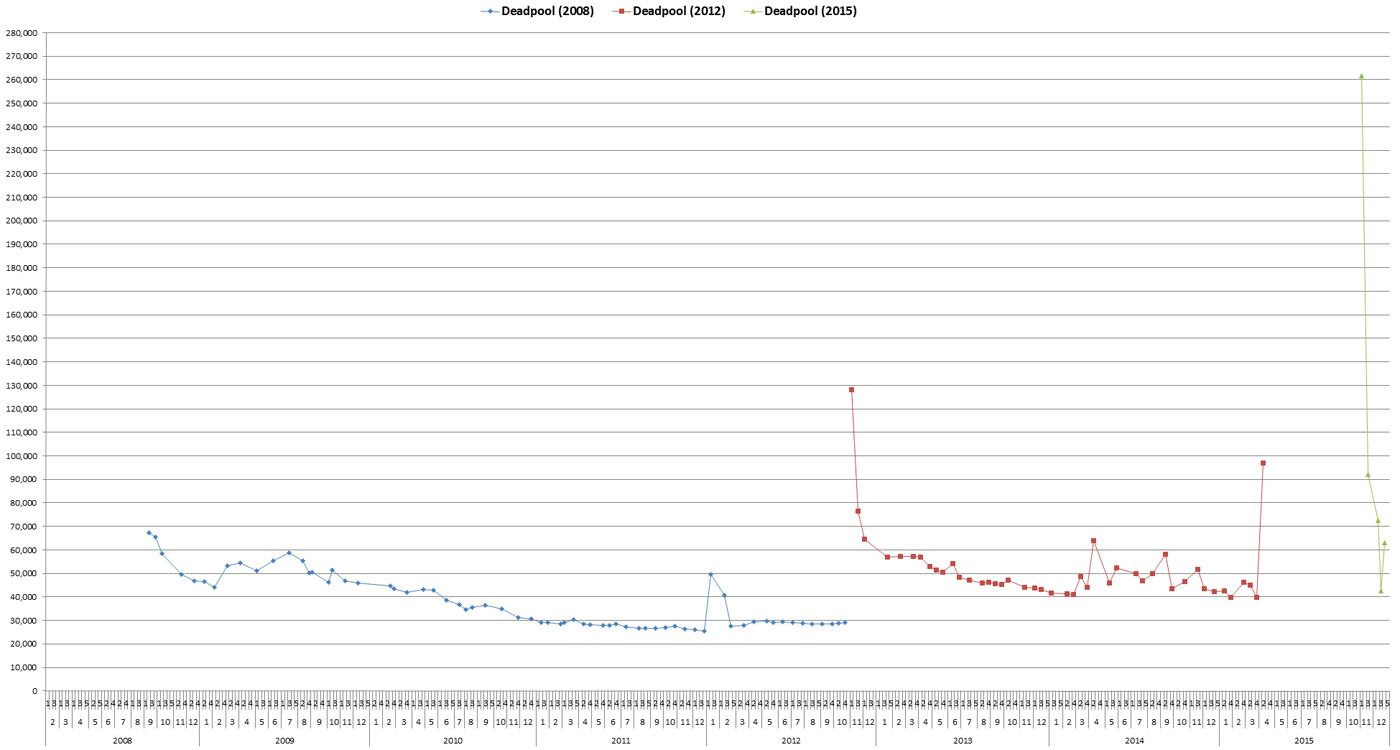

"Deadpool" is an interesting title to examine in December, with four different issues on the chart. The best-selling of the bunch was "Deadpool" #1 with 81,239 units of reorder activity after the 180,565 units from November. "Deadpool" #3 dropped 21.36% from the second issue to 72,356 units. "Deadpool" #3.1 sold 42,614 units, and can be considered part of the ongoing series or a one-shot. "Deadpool" #4 sold 63,148 units. The most likely explanation for the reorder activity on the first issue is a subscription box order. Last I checked, the only HeroBox available at SuperHeroStuff was for Deadpool, so that is a likely place, though it could just as easily by LootCrate or one of the other subscription boxes. If the reorder activity represented the series being a sleeper hit or a reflection of new interest in the character because of the upcoming movie, we should have seen a bump in sales of the other issues. We might see an uptick in sales in the next month or two, but I think it is more likely the reorder activity was from a bulk purchase.

Over at DC, "Dark Knight III: The Master Race" #2 took second place on the top 300 comics list with 158,187 units, down 64.78% from the first issue. "Dark Knight III: The Master Race [Collector's Edition]" #1 sold 24,005 units indicating there is a strong interest in the slightly oversized format of the miniseries. Because the two versions have different prices and are being reported distinctly from each other by Diamond, I'll be treating them as if they are different titles.

"Batman/Teenage Mutant Ninja Turtles" #1 launched with 134,526 units and "Batman" #47 sold 127,201 units, up 18.89% presumably due to the open-to-order Alex Ross covers. The only other DC titles to sell over 50,000 were "Harley's Little Black Book" #1, "Justice League" #47 and #46, "Harley Quinn" #23 and "Justice League of America" #6.

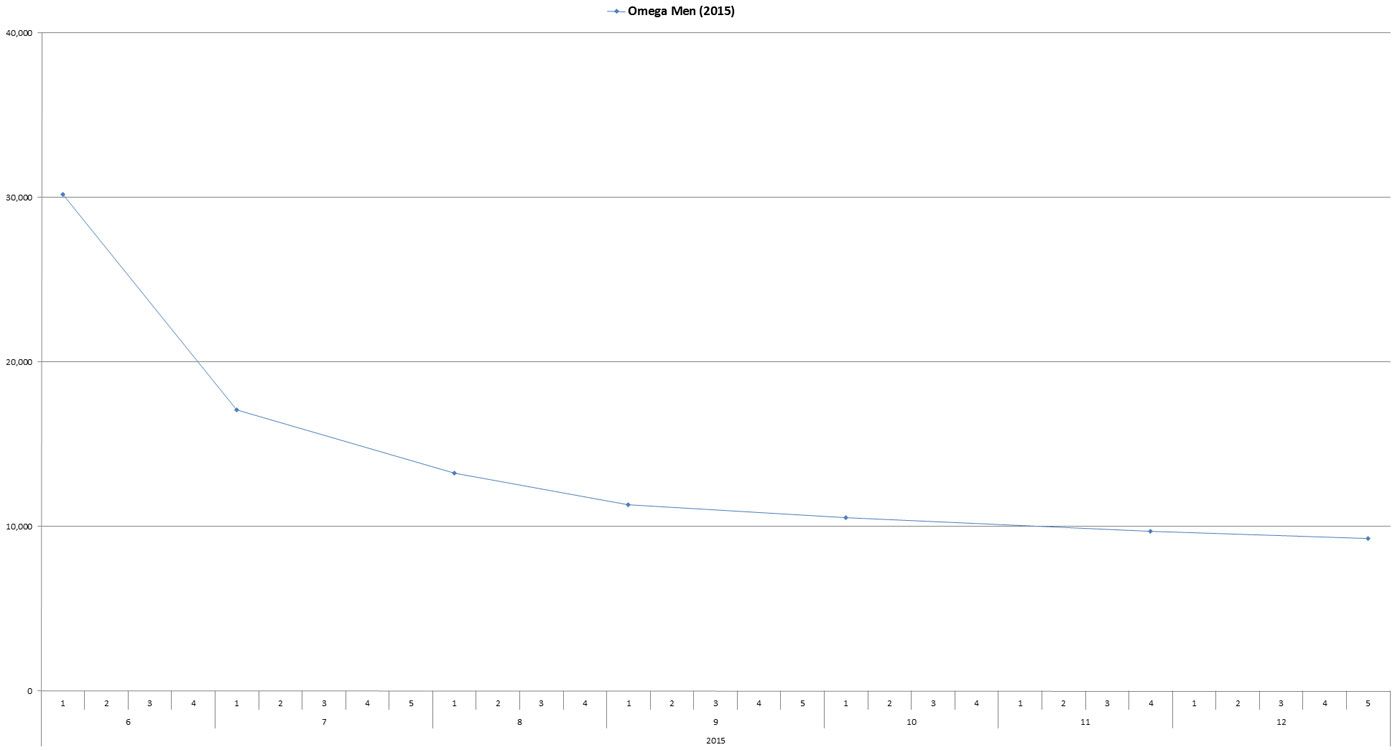

"Telos" #3 sold 9,618 units, down 14.13% from the second issue; the series is ending with the sixth issue. Other titles which might not last beyond the current story arc include "Midnighter," "Doctor Fate," "Justice League 3001," "Secret Six," "Catwoman," "Gotham Academy," Martian Manhunter," "Justice League United," "Sinestro," "Cyborg" and "Constantine: The Hellblazer." The earlier in that list the title is, the more likely it is to end. The only reason I didn't start that list with "Omega Men" is because it has already been canceled at #6 only to be uncanceled and extended to #12. "Omega Men" #7 was down another 4.73% and sold only 9,250 units, so it is extremely unlikely the series will be granted another extension. Given how the series has been selling, DC probably should have wrapped up the series with the sixth issue.

A number of DC titles had significant bumps in sales in December. Some, like "We Are Robin," "Teen Titans," "Red Hood/Arsenal" and "Gotham Academy" were due to the "Robin War" crossover storyline. Open-to-order variant covers on " Batman," "Justice League," "Harley Quinn," "Superman," "Green Lantern," "Flash," "Wonder Woman," "Green Arrow" caused the bump on those titles.

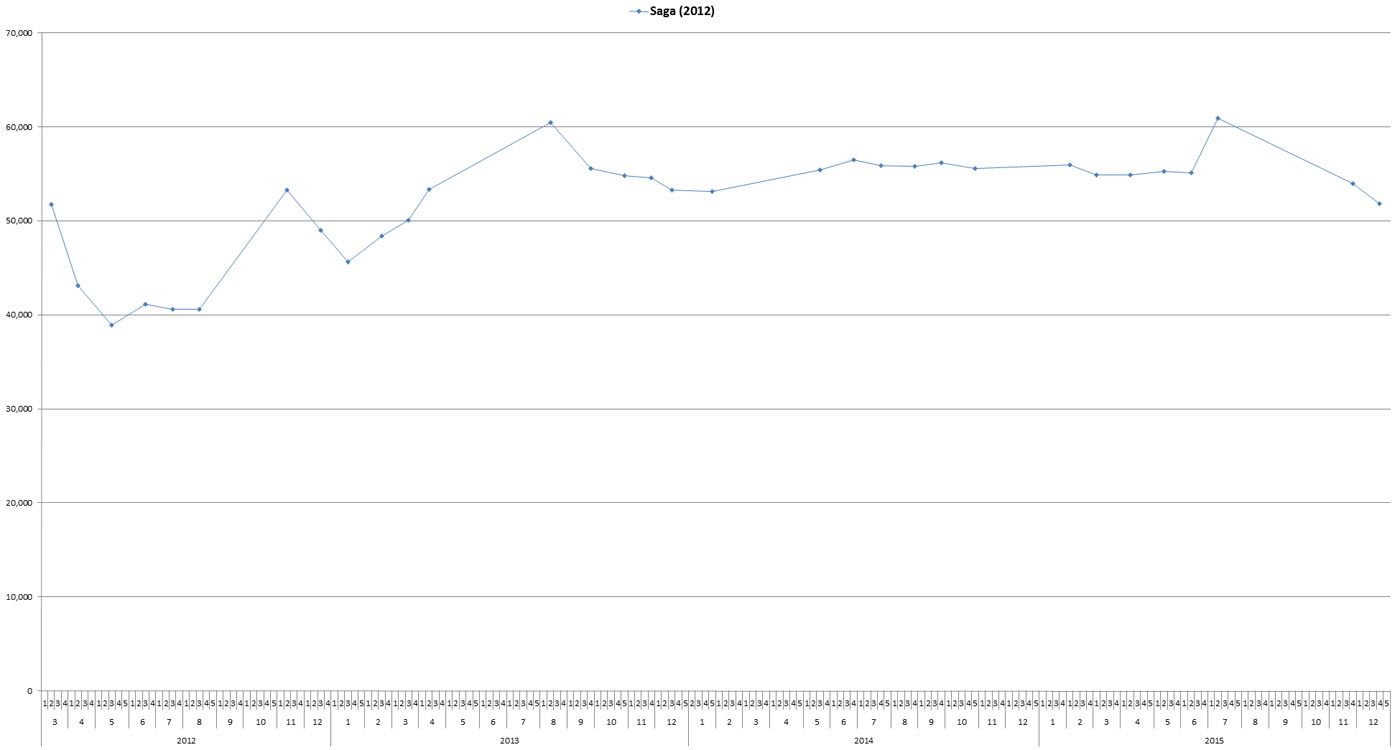

Over at Image, "The Walking Dead" #149 sold 65,405 units, down only 0.18% from the previous issue. We will likely see a bump in sales on the next issue between it being a "milestone" issue number and the issue having several variants. The only Image issue is December to increase in sales over the previous issue was "Spawn" #259 which was up 11.50% to 16,906 units. The issue began a new story arc that promises to change the character of Spawn forever. Maybe it will have the profound impact on the character promised, maybe it won't. Either way, sales increased on the issue. "Saga" #2 sold 51,850 units. The seems to have peaked just below 61,000 units and might be starting to slide a little.

"Back to the Future" #3 was the best-selling comic for IDW in December with 25,951 units. The miniseries has been promoted to an ongoing title due to the successful sales of the series.

"James Bond" #2, which shipped at the beginning of December, dropped by 40.35% from the first issue sales of 35,631 units to 21,254 units. "James Bond" #3, which shipped at the end of December, dropped another 16.58% down to 17,730 units. A property like Bond, which is well known outside of the comic book market, could do well in the bookstores once it is collected into trade paperbacks or hardcovers.

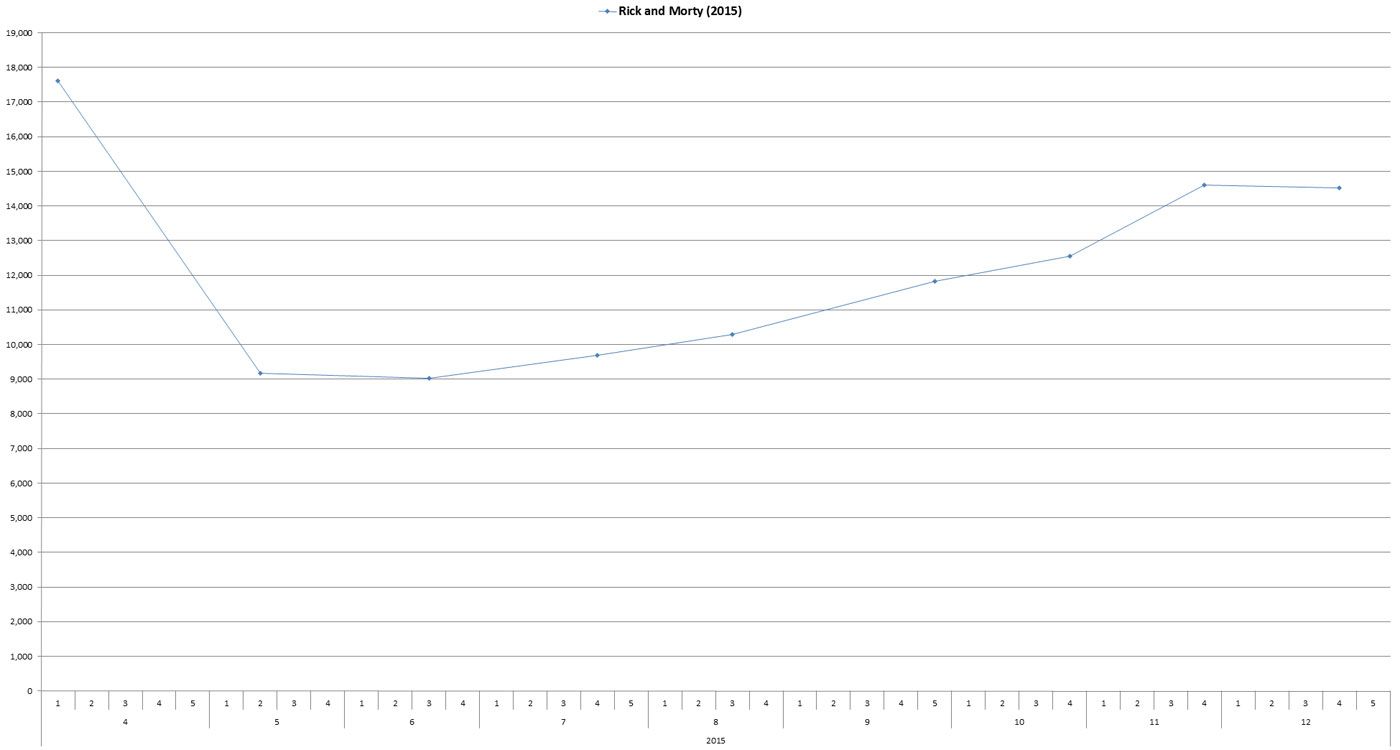

"Rick and Morty" #9 from Oni Press sold 14,526 units, down 0.53% from the previous issue. This is the only issue aside from the second issue to drop in sales, and the title has been slowly recovering from the second issue drop. While it is too early to tell, this could be another one of those rare cases in which a title finds an audience which grows over time.

The best-selling collected edition of the month was the "Private Eye" hardcover which sold 7,844 units of the Image Comics print edition of Brian K. Vaughn and Marcos Martin's digital series from PanelSyndicate.com. Hopefully the hardcover will continue to sell in print over time. The PanelSyndicate.com model for digital comics is a pay-what-you-think-it-is-worth model, which I really respect. The kind of business model really seems to push the creative team to do the best job they possibly can.

If you'd like to listen to an in-depth discussion of the sales data, check out the Mayo Report episodes of the Comic Book Page podcast at www.ComicBookPage.com covering the past decade of comic book sales. In addition to those episodes, every Monday is a Weekly Comics Spotlight episode featuring a comic by DC, a comic by Marvel and a comic by some other publisher. I read around 200 new comics a month so the podcast covers a wide variety of what is currently being published. If you are looking for more or different comics to read, check out the latest Previews Spotlight episode which features clips from various comic book fans talking about the comics they love. With thousands of comics in Previews every month, Previews Spotlight episodes are a great way to find out about things which may have flown under your comic book radar.

As always, if you have any questions or comments, please feel free to email me at John.Mayo@ComicBookResources.com.