February 2015 was another strong month for Marvel, which accounted for 43.39% of the total units for the top 300 comics and 46.35% of the total dollars. DC was a million units and $5.5 million lower with 29.24% of the units and 26.14% of the dollars. Image continues to stay right around the 10% mark with 10.07% of the units and 9.42% of the dollars, while IDW Publishing had a strong month with 8.67% of the units and 9.03% of the dollars. IDW is unlikely to repeat that success next month since nearly 80% of the units and dollars came from a single item: "Orphan Black" #1.

"Orphan Black" #1 from IDW was the best-selling comic in February 2015, moving approximately 497,002 units. The issue has multiple covers, which no doubt played a part in the high sales. The eight different Cat Staggs covers shipped in an equal ratio, meaning for every eight copies a retailer ordered, they get one of each cover. There was a boxed set of the eight covers for a cover price of $29.99. In addition, there was a subscription variant which was independently orderable. But the variant which is the most likely reason for the nearly half million units is the March 2015 LootCrate-exclusive cover.

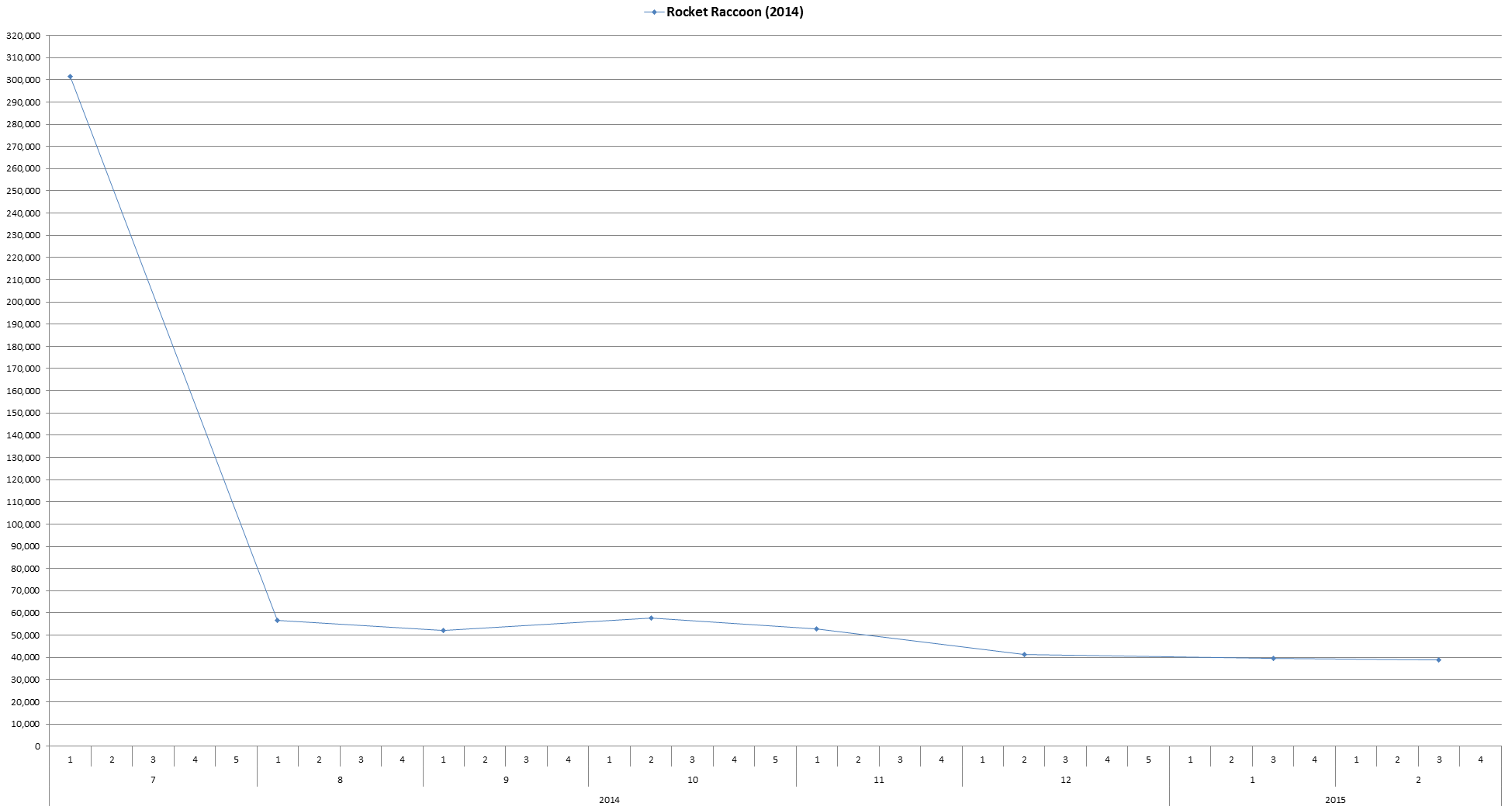

Once again, the Diamond data is mixing sales to retailers which are a reflection of sales to readers with bulk purchases which are of a fundamentally different nature. The outlook for "Orphan Black" would be much better if the sales of the first issue were based on reader interest as filtered/predicted by retailers than if the sales are based on what a buyer at LootCrate or any other subscription box service thinks would be a good item to include in the monthly box. The first type of sales indicates an interest in the particular item which can be used to gauge future interest in the title while the second is generally a one-time spike in sales which is next to useless for gauging future interest in the title. "Rocket Raccoon" #1 sold 293,913 units in July 2014 thanks to LootCrate. "Rocket Raccoon" #8 sold an estimated 38,769 units.

The first issue sales of "Rocket Raccoon" were clearly boosted by the LootCrate deal and those units sold in bulk to LootCrate were reported in a misleading way. If Diamond wants to continue to include these bulk purchases in the data then they should clearly mark which items had such bulk purchases. Not marking these items gives the impression the sales are of the same nature as the rest of the sales which simple isn't true.

This is the first time IDW has placed in the top 10 during the final order era (which began in early 2003). Its previous high ranking items were "My Little Pony: Friendship is Magic" #1, which sold an estimated 80,128 units in November 2012, and "Godzilla: Kingdom of Monsters" #1 which had at least 75 different covers helping it sell around 58,879 units in March 2011. One obvious common element to all three of those comics is they are licensed properties which are well known outside of the comic book community.

"Orphan Black" #1 outsold "Darth Vader" #1 from Marvel, which sold an estimated 264,399 units and "Spider-Gwen" #1 which sold around 254,074 units. "Star Wars" #2 dropped over 84% but still sold an estimated 162,042 units placing it well ahead of "Batman" #39, which rounded out the top 5 with an estimated 118,106 units. "Darth Vader" #2 also shipped in February sold around 100,010 units after a drop of over 62%.

Despite the massive drops on the second issues of "Star Wars" and further drops on the third issue being something of a statistical certainly, the title is already within what could be considered a sustainable range. Normally, I wouldn't suggest sales over 100,000 units would be sustainable, but prior to the current series of "Batman" it wasn't something we'd seen for a period of years on any title, but Scott Synder Greg Capullo's run of "Batman" has proven selling over 100,000 for multiple years can be done. Given the inherent popularity of the Star Wars property, it is reasonable to suspect "Star Wars" could continue to sell over the 100,000 unit mark for the long haul. The long term success of the title depends on Marvel continuing to devote top tier talent to it. The Star Wars property is a bit of an odd duck for Marvel. It technically is a licensed property but since it is licensed from another branch of Disney, it is sort of a house property even if it isn't an in-house property. While it makes sense for Marvel to put top tier talent on those titles, no doubt Marvel would be just as happy putting those same creative teams on Marvel in-house properties.

"Spawn" #250 sold approximately 60,357 units, an increase of nearly 400% over the previous issue. As one of the people who sampled that issue, I can say that while I enjoyed the issue, it failed to get me back as a regular reader. Then again, I dropped the title around issue #50 so, "Spawn" getting back on my reading list was unlikely. It begs the question of if these attempts to grab new readers have any real chance of working these days. For ongoing titles and properties, they only seem to work when there is a real change to the title or property such as a new creative team or a major shift in direction. Most of the titles I've been adding to my reading list are new properties. And, frankly, more than I care to admit are ones that I passed on preordering and added after my podcast cohost suggested we review them. I've given it a lot of thought since writing my article last month, and I think one of the major contributors to weak sales is the solicitations.

Comics are a preorder business. Even if you, as a reader, don't preorder, your retailer does. The solicitations are the information used for preordering. Any savvy retailer is going to base orders on how things at that store are currently selling. I'm not trying to downplay that part of the equation. Frankly, it is the more important part of the equation, but each store and each person ordering for a store is unique. While there are some commonalities, the differences in the customer base at each store and the mindset of each retailer is the driving force of how each store orders. The only truly common element for preordering is the solicitations. For most comics, the solicitation boils down to a cover image and a few sentences. For the majority of publishers and comics, the cover image is about 1.75 inches wide and 2.75 inches tall in Previews, with the solicitation text being a column inch or two. Premiere publishers and some of the larger ones in the back half of Previews get a little more space and those are also the publishers and items which tend to sell better.

There is certainly a correspondence between the two items, but I'm not entirely certain there is a causality between a less space and a smaller cover image in Previews and lower sales. In addition to the less space, these items in the back half are generally lesser known properties by lesser known creators. But even the items from the major publishers with full size cover images tend to lack much in the way of relevant details about the issue needed for making an informed purchasing decision. The additional information needed isn't and shouldn't be spoilers but it needs to be something more than either a vague teaser for the issue or high level elevator pitch for the series.

The solicitations coming out now are of vital importance for Marvel and DC. Both companies are basically putting their ongoing titles on hold to some degree for a major event. "Convergence" at DC and "Secret Wars" at Marvel are both clearly drawing a line in the sand for each company with what comes after being promised as being different from what came before in some meaningful way. We'll see if that holds true or not. Both Marvel and DC are big enough companies that going back to print on surprise hits is possible. Most other publishers simply lose out on potential readers if they don't get them on board with the first issue. Getting those first issues sales depends on having a solicitation which convinces people to buy the issue.

Ironically, the biggest solicitation failure recently was Marvel somehow not including "Secret Wars" #1 in the February Marvel Previews, though it's doubtful it will impact the sales of the miniseries which Marvel has been promoting for the past six to nine months.

If you'd like to listen to an in-depth discussion of the sales data, check out the Mayo Report episodes of the Comic Book Page podcast at www.ComicBookPage.com. In addition to those episodes, every Monday is a Weekly Comics Spotlight episode featuring a comic by DC, a comic by Marvel and a comic by some other publisher. I read around 200 new comics a month so the podcast covers a wide variety of what is current being published. If you are looking for more or different comics to read, check out the latest Previews Spotlight episode which features clips from various comic book fans talking about the comics they love. With thousands of comics in Previews every month, Previews Spotlight episodes are a great way to find out about things which may have flown under your comic book radar.

As always, if you have any questions or comments, please feel free to email me at John.Mayo@ComicBookResources.com.