The day before New York Comic Con, a group of comics insiders gathered at the ICv2 Conference to hear Milton Griepp's White Paper, his annual overview of sales and trends in the comics market. His figures showed that sales are up in all channels--comics shops, retail bookstores and digital comics--and he also presented data showing that new readers are coming to the medium in a variety of ways.

Griepp estimated the total comics market at $870 million in 2013, of which $780 million was print and $90 million was digital. Specialty comics shops are the biggest sales channel, with comics sales of about $340 million and graphic novel sales of about $170 million last year. The retail book channel was next, with an estimated $245 million in graphic novel sales, and newsstand sales came to $25 million. (Dollar sales are calculated as unit sales multiplied by cover price, with no allowance for discounts.)

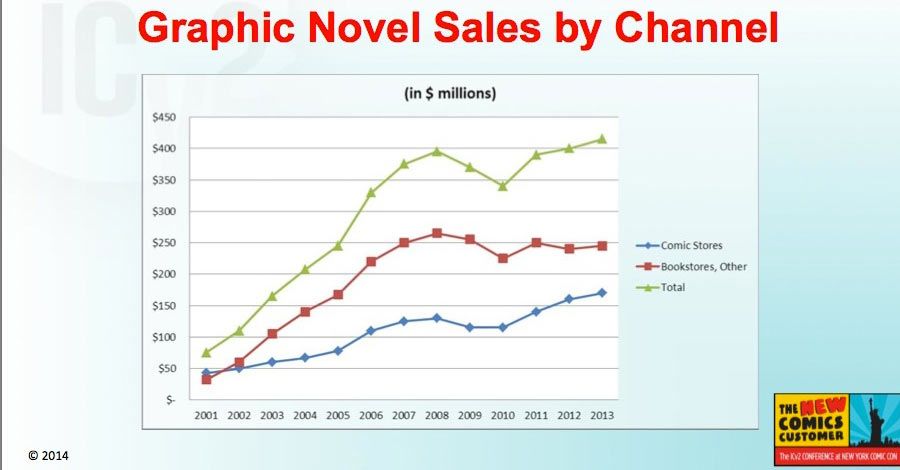

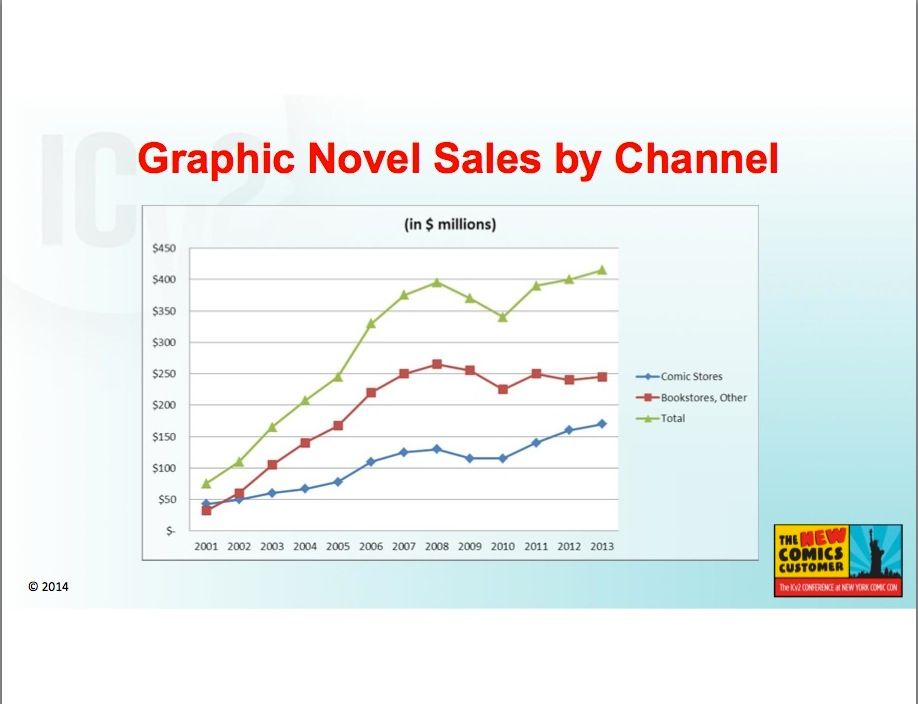

Graphic novels are the most popular format, with $415 million in sales in 2013, compared to comics, which totaled $365 million. In recent years, comics sales have been growing faster, but graphic novel sales surpassed comics sales about ten years ago.

Looking at sales trends over the past nine years, Griepp observed that sales have rebounded after a decline in 2009 and 2010. "Part of that was the economy, and people pulling back on buying," he said, "but I also think a lot of the business is driven creatively, and I think there was a little creative drought in that period that has since reversed, and I think we have really, really great stuff being published now." The overall market is up 35% since 2010, and Griepp pointed out that the numbers repudiate the notion that as digital sales go up, other sales go down. "Clearly, all of them are going up," he said.

One possible reason for the growth in the overall market is that many areas don't have comic shops, so in the past, potential customers might have had nowhere to buy comics. "What retailers tell me, and the limited data that has been released agrees, is there are people who used to buy print that now are buying some or all digital," Griepp said. "There has been some cannibalization, but that is more than made up for by people who were engaged or re-engaged by digital and otherwise would not be participating in the market at all. So net-net, it is a plus."

Sales of graphic novels have grown steadily in comics shops but have been flatter in bookstores over the past few years. On the other hand, there are 600 fewer bookstores now than before Borders closed its doors in 2011. "The fact that the book channel has held on as well as it has despite the loss of so many doors, and such a big percentage of the doors, I think is actually a pretty positive sign," Griepp said, noting that with flat sales and fewer stores, dollar sales per store are going up.

Manga sales were up 8%, the first increase in that category since 2007, for a total market value of $70 million. Griepp attributed the drop in recent years to the loss of the Borders chain, less anime being shown on Cartoon Network, and the lack of a blockbuster series; the category had its first hit in several years with "Attack on Titan."

Looking at the most recent numbers, sales of periodical comics were up 9% in 2013 but only 3% so far in 2014; sales were flat for most of the year but picked up in the third quarter. "There has been a slowing of the pace of growth in the comics space," Griepp said. Graphic novels, on the other hand, were up 4% in 2013 but grew by "double digits" in 2014.

Digital sales were up 29% in 2013, but Griepp described sales this year as "flat-ish." Growth was slowing going into the year, he said, and the largest digital comic distributor, comiXology, stopped offering in-app purchases of comics in April, after it was acquired by Amazon. "Publishers have told us that had an impact on sales, at least in that initial period," he said. The growth of ebook sales has also slowed, and Griepp thinks the market is changing in ways that aren't clear yet. "Overall, I think Amazon brings huge resources to comiXology, in terms of its ability to use customer data, its financial resources, and its customer base," he said. "Long term, we expect growth to continue, but there has been a little bit of a pause so far this year."

After that, Griepp turned to "the new comics customer," drawing information from several sources.

He began by looking at sales in the direct market and bookstores in the summer of 2014. The analysis showed that 67% of sales (in dollars) were of adult properties, 14% were children's comics and graphic novels, and 19% were manga.

Griepp estimated the value of the children's graphic novel market at between $60 million and $70 million. "That's a significant and growing and important part of the business, for a variety of reasons," he said. "Not just because it is a segment that wasn't there ten years ago, but also because young readers turn into older readers and help feed the market overall."

In terms of the different channels, 36% of the sales recorded last summer were in comic shops and 64% in bookstores. While sales of adult properties were split evenly across the two channels, 92% of manga and 88% of children's titles were sold in bookstores and book fairs. "That's a big opportunity for comics stores," said Griepp. "It's a market they are not getting their share of, and it's a sign that a lot of new customers, nontraditional customers, are shopping in the book channel." He also noted that sales of children's graphic novels were up 10% in summer 2014 compared to summer 2013, mirroring the growth in the overall comics market.

To look at the gender of comics readers, Griepp turned to Facebook data compiled by political consultant Brett Schenker, who found that the number of self-identified comics fans (people who "liked" a comics term in their profiles) went up 50% in the past year, and that the male/female split was roughly 45% female to 55% male, although the percentage of women increased slightly over the course of the year.

By comparison, DC Comics did a survey of its readers shortly after the New 52 launch in 2011 and found they were 93% male. "Has all of that changed?" Griepp asked. "Probably not, but I think the difference between this audience and the Facebook audience is very stark. I think it demonstrates some change over time, and I think it is the difference between an audience that likes comics overall and the audience that likes superhero comics, or in this case the DC Universe comics."

Griepp had several explanations for where the new readers were coming from. "Content is always king," he said, pointing to several recent best-sellers, including "The Walking Dead," "Saga," Roz Chast's memoir "Can't We Talk About Something More Pleasant?" and Raina Telgemeier's "Sisters." "From my perspective of 40 years in the comics business, the variety and quality of what is being published today is the greatest it's been in my lifetime," he said. "I think that content is a big part of not only attracting new customers but reactivating lapsed customers; they left for a reason in many cases and came back because there was something they wanted to read again."

Schools and libraries are also bringing in young readers. "Part of the reason we are seeing great comics growth now is that over the last decade, committed librarians and teachers presented graphic novels as a great reading experience and a great way to learn, and that is carrying on as those kids make their own purchasing and reading decisions instead of having their parents make them."

He also discussed the importance of "making comics available where the customers are." Digital seems to be attracting more women; last year, just before NYCC, comiXology stated that the percentage of women in their customer base had grown from 5% to 20%. Digital has also been a portal to comics for fans of properties in other media, such as "The Walking Dead" and "My Little Pony," and those digital buyers often progress to print. Graphic novels are making inroads into mass-market stores such as Wal Mart, and comics also show up in combination packs with toys; bookstores remain an important market for new readers; progressive comics shops are carrying and featuring a wider range of comics, going beyond the traditional superhero titles.

The growth of comics conventions has provided new paths for readers to find comics, as has social media. Griepp had a personal testimony to the power Tumblr: His 16-year-old daughter discovered "Lumberjanes" via her friends on Tumblr. "I think that was the first periodical comic she ever read, and I didn't introduce her to it," he said. Several of the creators had followings on Tumblr, and publisher BOOM! Studios promoted it there as well, and Greipp credited that exposure for boosting what was an "off-genre" comic for most retailers

Media exposure has a "huge" impact, Griepp said, adding "It's only getting bigger." And now it's not just television but streaming media as well: Sales of the manga series "Attack on Titan" skyrocketed after the anime became available via several streaming sites. Griepp ended the White Paper by presenting several charts detailing the increase in sales of related merchandise (comics and other items) for a number of properties, including "The Walking Dead," "My Little Pony," and "Iron Man."